| | | | | | | | |

|

|

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549 SCHEDULE 14A |

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

☒ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

(Name of Registrant as Specified In Its Charter)

| | | | | | | | |

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee paid previously with preliminary materials

.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

PRELIMINARY PROXY STATEMENT– SUBJECT TO COMPLETION

13241 Woodland Park Road, Suite 300

Herndon, Virginia 20171

(through August 31, 2024)

2411 Dulles Corner Park, Suite 300

Herndon, Virginia 20171

(effective September 1, 2024)

(571) 267-1571

July 25, 2024

Dear Fellow Stockholders:

We are pleased to invite you to attend the annual meeting of stockholders of BlackSky Technology Inc., to be held on Wednesday, September 4, 2024 at 1:00 p.m., Eastern time. The annual meeting will be a virtual meeting held over the Internet. You will be able to attend the virtual annual meeting, vote your shares electronically, and submit your questions during the live webcast of the meeting by visiting www.virtualshareholdermeeting.com/BKSY2024 and entering the sixteen-digit control number located on your proxy card.

The attached formal meeting notice and proxy statement contain details of the business to be conducted at the virtual annual meeting.

Your vote is important. Whether or not you attend the virtual annual meeting, it is important that your shares be represented and voted at the annual meeting. Therefore, we urge you to vote and submit your proxy promptly via the Internet, telephone or mail.

On behalf of our Board of Directors, I would like to express our appreciation for your continued support of and interest in BlackSky.

Sincerely,

Brian O’Toole

Chief Executive Officer, President and Director

BLACKSKY TECHNOLOGY INC.

13241 Woodland Park Road, Suite 300, Herndon, Virginia 20171 (through August 31, 2024)

2411 Dulles Corner Park, Suite 300, Herndon, Virginia 20171 (effective September 1, 2024)

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

| | | | | | | | | | | |

| Time and Date | 1:00 p.m., Eastern time, on Wednesday, September 4, 2024 | |

| Place | The annual meeting will be conducted virtually via live audio webcast. You will be able to attend the annual meeting by visiting www.virtualshareholdermeeting.com/BKSY2024, where you will be able to listen to the meeting live, submit questions and vote online during the meeting. | |

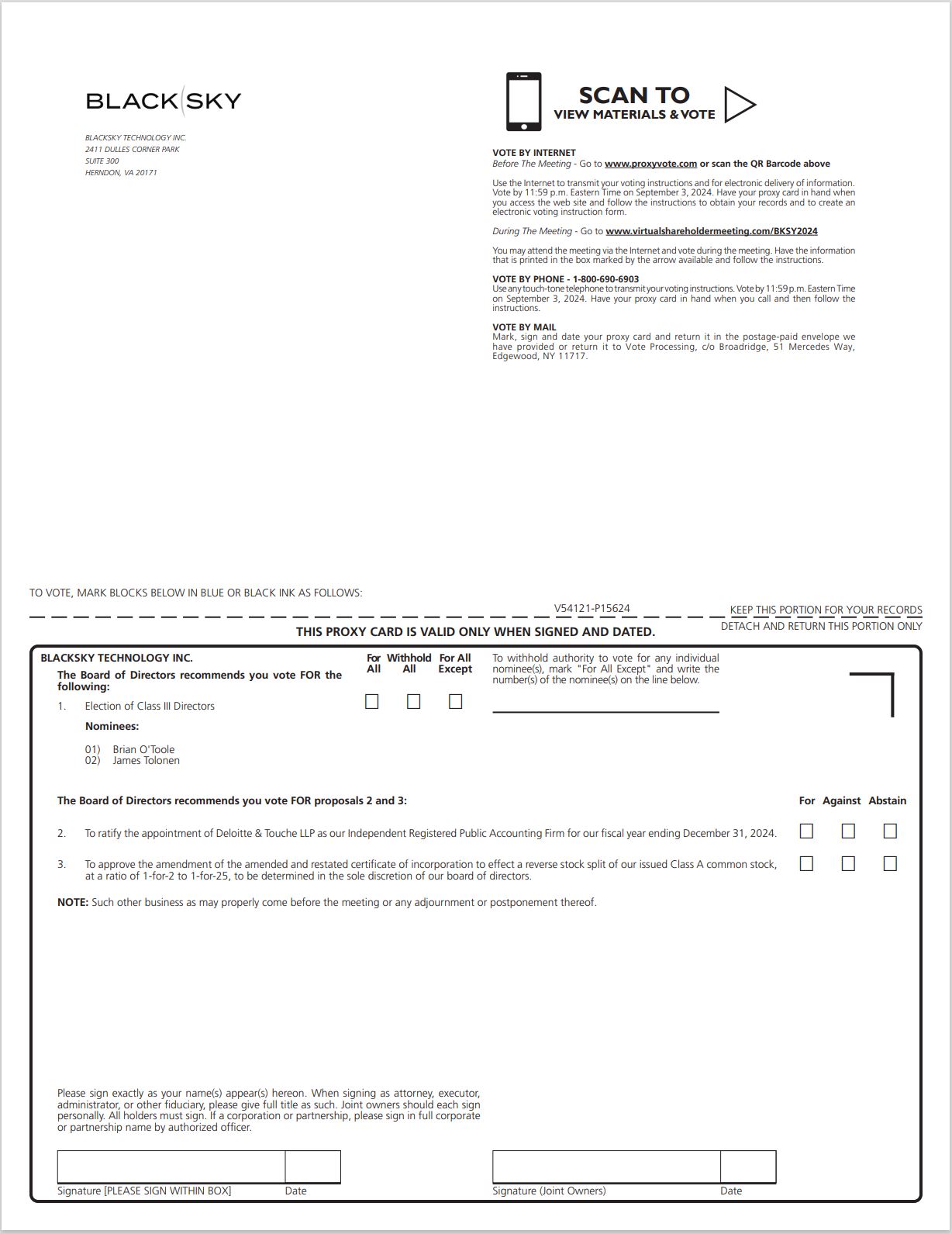

| Items of Business | •To elect Brian O’Toole and James Tolonen as Class III directors to hold office until our 2027 annual meeting of stockholders and until their respective successors are elected and qualified. •To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2024. •To approve an amendment to our amended and restated certificate of incorporation to effect a reverse stock split of our issued Class A common stock, at a ratio of 1-for-2 to 1-for-25, to be determined in the sole discretion of our board of directors. •To transact other business that may properly come before the annual meeting or any adjournments or postponements thereof. | |

| Record Date | July 16, 2024 Only stockholders of record as of July 16, 2024 are entitled to notice of and to vote at the annual meeting. A list of the stockholders of record entitled to vote at the annual meeting will be available for examination, for any purpose germane to the annual meeting, during ordinary business hours for ten days prior to the annual meeting at our principal executive offices located at 13241 Woodland Park Road, Suite 300, Herndon, Virginia 20171 (through August 31, 2024) or 2411 Dulles Corner Park, Suite 300, Herndon, Virginia 20171 (effective September 1, 2024). Stockholders interested in viewing the list can contact our corporate secretary to schedule an appointment by writing to BlackSky Technology Inc., Attn: Corporate Secretary, 2411 Dulles Corner Park, Suite 300, Herndon, Virginia 20171. The stockholder list will also be available online during the annual meeting. | |

| Availability of Proxy Materials | The Notice of Internet Availability of Proxy Materials, containing instructions on how to access our proxy statement, notice of annual meeting, form of proxy and our annual report, is first being sent or given on or about July 25, 2024 to all stockholders entitled to vote at the annual meeting. The proxy materials and our annual report can be accessed as of July 25, 2024 by visiting www.proxyvote.com. | |

| Voting | Your vote is important. Whether or not you plan to attend the annual meeting, we urge you to submit your proxy or voting instructions via the Internet, telephone or mail as soon as possible. | |

| By order of the Board of Directors,

Brian O’Toole

Chief Executive Officer, President and DirectorHerndon, Virginia

July 25, 2024 |

TABLE OF CONTENTS

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND OUR ANNUAL MEETING 1

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE 8 Composition of the Board 8 Board Leadership Structure 11 Role of Our Board of Directors in Risk Oversight 12 Committees of the Board of Directors 12 Compensation Committee 14 Nominating and Corporate Governance Committee 14 Attendance at Board and Stockholder Meetings 14 Compensation Committee Interlocks and Insider Participation 14 Executive Sessions of Non-Employee Directors 15 Considerations in Evaluating Director Nominees 15 Stockholder Recommendations and Nominations to our Board of Directors 15 Communications with the Board of Directors 16 Policy Prohibiting Hedging or Pledging of Securities 16 Corporate Governance Guidelines and Code of Business Conduct and Ethics 17 Director Compensation for Fiscal Year 2023 18

PROPOSAL NO. 1: ELECTION OF CLASS III DIRECTORS 20

PROPOSAL NO. 2: RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM 21 Fees Paid to the Independent Registered Public Accounting Firm 21

PROPOSAL NO. 3: APPROVAL OF THE REVERSE STOCK SPLIT 23 Reasons for the Reverse Stock Split 23 Effects of the Reverse Stock Split 25 Certain Risks Associated with the Reverse Stock Split 26 Certain Material U.S. Federal Income Tax Consequences of the Reverse Stock Split 27

REPORT OF THE AUDIT COMMITTEE 30

EXECUTIVE COMPENSATION 33 Compensation and Governance Practices and Policies 33 Named Executive Officers 34 Summary Compensation Table 35 Components of Executive Officer Compensation 35 Executive Compensation Arrangements 36 2023 Executive Bonus Program 37 Executive Change in Control and Severance Plan 37 Outstanding Equity Awards at 2023 Fiscal Year-End 39 Equity Compensation Plan Information 40

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT 42

RELATED PERSON TRANSACTIONS 44 Certain Relationships and Related Person Transactions 44 Policies and Procedures for Review and Approval of Related Person Transactions 47

Stockholder Proposals or Director Nominations for 2025 Annual Meeting 49 Availability of Bylaws 50 Delinquent Section 16(a) Reports 50 Incorporation by Reference 50

ANNEX A – CERTIFICATE OF AMENDMENT TO THE AMENDED AND RESTATED

CERTIFICATE OF INCORPORATION A-1

BLACKSKY TECHNOLOGY INC.

PROXY STATEMENT

FOR 2024 ANNUAL MEETING OF STOCKHOLDERS

To be held at 1:00 p.m., Eastern time, on Wednesday, September 4, 2024

The information provided in the “question and answer” format below is for your convenience only and is merely a summary of the information contained in this proxy statement. You should read this entire proxy statement carefully. As used in this proxy statement, references to “we,” “us,” “our,” “BlackSky” and the “Company” refer to BlackSky Technology Inc., a Delaware corporation, and its subsidiaries.

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND OUR ANNUAL MEETING

Why am I receiving these materials?

This proxy statement and the form of proxy are furnished in connection with the solicitation of proxies by our board of directors for use at the 2024 annual meeting of stockholders of BlackSky Technology Inc., a Delaware corporation, and any postponements, adjournments or continuations thereof. The annual meeting will be held on Wednesday, September 4, 2024 at 1:00 p.m., Eastern time. The annual meeting will be conducted virtually via live audio webcast. You will be able to attend the annual meeting virtually by visiting www.virtualshareholdermeeting.com/BKSY2024, where you will be able to listen to the meeting live, submit questions and vote online during the meeting.

The Notice of Internet Availability of Proxy Materials, or Notice of Internet Availability, containing instructions on how to access this proxy statement, the accompanying notice of annual meeting and form of proxy, and our annual report, is first being sent or given on or about July 25, 2024 to all stockholders of record as of July 16, 2024. The proxy materials and our annual report can be accessed as of July 25, 2024 by visiting www.proxyvote.com. If you receive a Notice of Internet Availability, then you will not receive a printed copy of the proxy materials or our annual report in the mail unless you specifically request these materials. Instructions for requesting a printed copy of the proxy materials and our annual report are set forth in the Notice of Internet Availability.

What proposals will be voted on at the annual meeting?

The following proposals will be voted on at the annual meeting:

•the election of Brian O’Toole and James Tolonen as Class III directors to hold office until our 2027 annual meeting of stockholders and until their respective successors are elected and qualified;

•the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2024; and

•the approval of an amendment to our amended and restated certificate of incorporation to effect a reverse stock split of our issued Class A common stock, par value $0.0001 per share (“common stock”), at a ratio of 1-for-2 to 1-for-25, to be determined in the sole discretion of our board of directors (the “Reverse Stock Split”).

As of the date of this proxy statement, our management and board of directors were not aware of any other matters to be presented at the annual meeting.

How does the board of directors recommend that I vote on these proposals?

Our board of directors recommends that you vote your shares:

•“FOR” the election of Brian O’Toole and James Tolonen as Class III directors;

•“FOR” the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2024; and

•“FOR” the approval of the Reverse Stock Split.

Who is entitled to vote at the annual meeting?

Holders of our common stock as of the close of business on July 16, 2024, the record date for the annual meeting, may vote at the annual meeting. As of the record date, there were shares of our common stock outstanding. Each share of common stock is entitled to one vote on each matter properly brought before the annual meeting. Stockholders are not permitted to cumulate votes with respect to the election of directors.

Stockholders of Record. If your shares are registered directly in your name with our transfer agent, Continental Stock Transfer & Trust Company, then you are considered the stockholder of record with respect to those shares, and the Notice of Internet Availability was sent directly to you by us. As a stockholder of record, you have the right to grant your voting proxy directly to the individuals listed on the proxy card or to vote on your own behalf at the annual meeting. Throughout this proxy statement, we refer to these holders as “stockholders of record.”

Street Name Stockholders. If your shares are held in a brokerage account or by a broker, bank or other nominee, then you are considered the beneficial owner of shares held in street name, and the Notice of Internet Availability was forwarded to you by your broker, bank or other nominee, which is considered the stockholder of record with respect to those shares. As a beneficial owner, you have the right to direct your broker, bank or other nominee on how to vote the shares held in your account by following the instructions that your broker, bank or other nominee sent to you. Throughout this proxy statement, we refer to these holders as “street name stockholders.”

Is there a list of registered stockholders entitled to vote at the annual meeting?

A list of registered stockholders entitled to vote at the annual meeting will be made available for examination by any stockholder for any purpose germane to the meeting for a period of at least ten days prior to the meeting during ordinary business hours at our principal executive offices located at 13241 Woodland Park Road, Suite 300, Herndon, Virginia 20171 (through August 31, 2024) or 2411 Dulles Corner Park, Suite 300, Herndon, Virginia 20171 (effective September 1, 2024). Stockholders interested in viewing the list can contact our corporate secretary to schedule an appointment by writing to BlackSky Technology Inc., Attn: Corporate Secretary, 2411 Dulles Corner Park, Suite 300, Herndon, Virginia 20171. The list of registered stockholders entitled to vote at the annual meeting will also be available online during the annual meeting at www.virtualshareholdermeeting.com/BKSY2024, for those stockholders attending the annual meeting.

How many votes are needed for approval of each proposal?

•Proposal No. 1: Each director is elected by a plurality of the voting power of the shares present virtually or represented by proxy at the annual meeting and entitled to vote on the election of directors. A plurality means that the nominees with the largest number of FOR votes are elected as directors. You may (1) vote FOR the election of each of the director nominees named herein, (2) WITHHOLD authority to vote for each such director nominee or (3) vote FOR the election of each director nominee other than any nominee with respect to whom the vote is specifically WITHHELD by indicating in the space provided on the proxy. Because the outcome of this proposal will be determined by a plurality vote, any shares not voted FOR a particular nominee, whether as a result of choosing to WITHHOLD authority to vote or a broker non-vote, will have no effect on the outcome of the election.

•Proposal No. 2: The ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2024 requires the affirmative vote of a majority of the voting power of the shares present virtually or represented by proxy at the annual meeting and entitled to vote thereon. You may vote FOR or AGAINST this proposal, or you may indicate that you wish to ABSTAIN from voting on this proposal. Abstentions will be counted for purposes of determining the presence or absence of a quorum and will also count as votes against this proposal, i.e., will have the same effect as a vote AGAINST this proposal. Because this is a routine proposal, we do not expect any broker non-votes on this proposal.

•Proposal No. 3: The approval of the Reverse Stock Split requires the affirmative vote of a majority of the votes cast affirmatively or negatively on such matter. You may vote FOR or AGAINST this proposal, or you may indicate that you wish to ABSTAIN from voting on this proposal. Abstentions will have no effect on the outcome of this proposal. Because this is a routine proposal, we do not expect any broker non-votes on this proposal.

Do the Company’s directors and officers have an interest in any of the matters to be acted upon at the annual meeting?

Members of our board of directors have an interest in Proposal 1, the election of the two director nominees to the board of directors as set forth herein, as each of the nominees is currently a member of the board of directors. Members of the board of directors and our executive officers do not have any interest in Proposal 2, the ratification of the appointment of our independent registered public accounting firm, or Proposal 3, the approval of the Reverse Stock Split.

What is the quorum requirement for the annual meeting?

A quorum is the minimum number of shares required to be present or represented at the annual meeting for the meeting to be properly held under our amended and restated bylaws and Delaware law. The presence, virtually or by proxy, of a majority of the voting power of our capital stock issued and outstanding and entitled to vote will constitute a quorum to transact business at the annual meeting. Abstentions, choosing to withhold authority to vote and broker non-votes are counted as present and entitled to vote for purposes of determining a quorum. If there is no quorum, the chairperson of the meeting may adjourn the meeting to another time or place.

What is the difference between holding shares as a record holder and as a beneficial owner (holding shares in street name)?

If your shares are registered in your name with our transfer agent, Continental Stock Transfer & Trust Company, you are the “record holder” of those shares. If you are a record holder, the Notice of Internet Availability has been provided directly to you by the Company.

If your shares are held in a stock brokerage account, a bank or other holder of record, you are considered the “beneficial owner” of those shares held in “street name.” If your shares are held in street name, the Notice of Internet Availability was forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the annual meeting. As the beneficial owner, you have the right to instruct this organization on how to vote your shares. Because you are not the stockholder of record, you may not vote your shares electronically during the annual meeting unless you request and obtain a valid proxy issued in your name from the broker, bank or other nominee considered the stockholder of record of the shares.

How do I vote and what are the voting deadlines?

Stockholder of Record. If you are a stockholder of record, you may vote in one of the following ways:

•by Internet at www.proxyvote.com, 24 hours a day, 7 days a week, until 11:59 p.m., Eastern time, on September 3, 2024 (have your proxy card in hand when you visit the website);

•by toll-free telephone at 1-800-690-6903, 24 hours a day, 7 days a week, until 11:59 p.m., Eastern time, on September 3, 2024 (have your proxy card in hand when you call);

•by completing, signing and mailing your proxy card (if you received printed proxy materials), which must be received prior to the annual meeting; or

•by attending the annual meeting virtually by visiting www.virtualshareholdermeeting.com/BKSY2024, where you may vote during the meeting (have your proxy card in hand when you visit the website).

Street Name Stockholders. If you are a street name stockholder, then you will receive voting instructions from your broker, bank or other nominee. The availability of Internet and telephone voting options will depend on the voting process of your broker, bank or other nominee. We therefore recommend that you follow the voting instructions in the materials you receive. If your voting instruction form or Notice of Internet Availability indicates that you may vote your shares through the www.proxyvote.com website, then you may vote those shares at the annual meeting with the control number indicated on that voting instruction form or Notice of Internet Availability. Otherwise, you may not vote your shares at the annual meeting unless you obtain a legal proxy from your broker, bank or other nominee.

What if I do not specify how my shares are to be voted or fail to provide timely directions to my broker, bank or other nominee?

Stockholder of Record. If you are a stockholder of record and you submit a proxy, but you do not provide voting instructions, your shares will be voted:

•“FOR” the election of Brian O’Toole and James Tolonen as Class III directors;

•“FOR” the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2024; and

•“FOR” the approval of the Reverse Stock Split.

In addition, if any other matters are properly brought before the annual meeting, the persons named as proxies will be authorized to vote or otherwise act on those matters in accordance with their judgment.

Street Name Stockholders. Brokers, banks and other nominees holding shares of common stock in street name for customers are generally required to vote such shares in the manner directed by their customers. In the absence of timely directions, your broker, bank or other nominee will have discretion to vote your shares on our routine matters: Proposal 2, the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2024, and Proposal 3, the approval of the Reverse Stock Split. Your broker, bank or other nominee will not have discretion to vote on any other proposals, which are considered non-routine matters, absent direction from you. In the event that your broker, bank or other nominee votes your shares on our routine matters, but is not able to vote your shares on the non-routine matters, then those shares will be treated as broker non-votes with respect to the non-routine proposals. Accordingly, if you own shares through a nominee, such as a broker or bank, please be sure to instruct your nominee how to vote to ensure that your shares are counted on each of the proposals.

Can I change my vote or revoke my proxy?

Stockholder of Record. If you are a stockholder of record, you can change your vote or revoke your proxy before the annual meeting by:

•entering a new vote by Internet or telephone (subject to the applicable deadlines for each method as set forth above);

•completing and returning a later-dated proxy card, which must be received prior to the annual meeting;

•delivering a written notice of revocation to our corporate secretary at BlackSky Technology Inc., Attn: Corporate Secretary, 2411 Dulles Corner Park, Suite 300, Herndon, Virginia 20171, which must be received prior to the annual meeting; or

•attending and voting at the annual meeting (although attendance at the annual meeting will not, by itself, revoke a proxy).

Street Name Stockholders. If you are a street name stockholder, then your broker, bank or other nominee can provide you with instructions on how to change or revoke your proxy.

Why is BlackSky holding a virtual annual meeting?

Our annual meeting will be held virtually via live audio webcast. The virtual format of the annual meeting allows us to preserve stockholder access while also saving time and money for both us and our stockholders.

We are committed to ensuring that stockholders will be afforded the same rights and opportunities to participate as they would at an in-person meeting, including the right to vote and ask questions during the meeting through the virtual meeting platform. The virtual meeting format includes the following features to provide for such an experience:

•the ability to submit appropriate questions up to 15 minutes in advance of the meeting;

•the ability to submit appropriate questions real-time via the meeting website, limiting questions to one per stockholder unless time otherwise permits; and

•answering as many questions submitted in accordance with the meeting rules of conduct as appropriate in the time allotted for the meeting.

What is the effect of giving a proxy?

Proxies are solicited by and on behalf of our board of directors. Henry Dubois and Christiana Lin, and each of them, with full power of substitution and re-substitution, have been designated as proxy holders for the annual meeting by our board of directors. When proxies are properly dated, executed and returned, the shares represented by such proxies will be voted at the annual meeting in accordance with the instructions of the stockholder. If the proxy is dated and signed, but no specific instructions are given, however, the shares will be voted in accordance with the recommendations of our board of directors on the proposals as described above. If any other matters are properly brought before the annual meeting, then the proxy holders will use their own judgment to determine how to vote your shares. If the annual meeting is postponed or adjourned, then the proxy holders can vote your shares on the new meeting date, unless you have properly revoked your proxy, as described above.

Who will count the votes?

A representative of L-Squared Elections will tabulate the votes and act as inspector of election.

How can I contact BlackSky’s transfer agent?

You may contact our transfer agent, Continental Stock Transfer & Trust Company, by telephone at 800-509-5586, or by writing Continental Stock Transfer & Trust Company, at 1 State Street 30th Floor, New York, NY 10004. You may also access instructions with respect to certain stockholder matters (e.g., change of address) via the Internet at www.continentalstock.com.

How are proxies solicited for the annual meeting and who is paying for such solicitation?

Our board of directors is soliciting proxies for use at the annual meeting by means of the proxy materials. We will bear the entire cost of proxy solicitation, including the preparation, assembly, printing, mailing and distribution of the proxy materials. Copies of solicitation materials will also be made available upon request to brokers, banks and other nominees to forward to the beneficial owners of the shares held of record by such brokers, banks or other nominees. The original solicitation of proxies may be supplemented by solicitation by telephone, electronic communications or other means by our directors, officers or employees. No additional compensation will be paid to these individuals for any such services, although we may reimburse such individuals for their reasonable out-of-pocket expenses in connection with such solicitation.

Where can I find the voting results of the annual meeting?

We will disclose voting results on a Current Report on Form 8-K that we will file with the U.S. Securities and Exchange Commission (the “SEC”), within four business days after the meeting. If final voting results are not available to us in time to file a Form 8-K, we will file a Form 8-K to publish preliminary results and will provide the final results in an amendment to the Form 8-K as soon as they become available.

Why did I receive a Notice of Internet Availability instead of a full set of proxy materials?

In accordance with the rules of the SEC we have elected to furnish our proxy materials, including this proxy statement and our annual report, primarily via the Internet. As a result, we are mailing to our stockholders a Notice of Internet Availability instead of a paper copy of the proxy materials. The Notice of Internet Availability contains instructions on how to access our proxy materials on the Internet, how to vote on the proposals, how to request printed copies of the proxy materials and our annual report, and how to request to receive all future proxy materials in printed form by mail or electronically by e-mail. We encourage stockholders to take advantage of the availability of the proxy materials on the Internet to help reduce our costs and the environmental impact of our annual meetings.

What does it mean if I receive more than one Notice of Internet Availability or more than one set of printed proxy materials?

If you receive more than one Notice of Internet Availability or more than one set of printed proxy materials, then your shares may be registered in more than one name and/or are registered in different accounts. Please follow the voting instructions on each Notice of Internet Availability or each set of printed proxy materials, as applicable, to ensure that all of your shares are voted.

I share an address with another stockholder, and we received only one copy of the Notice of Internet Availability or proxy statement and annual report. How may I obtain an additional copy of the Notice of Internet Availability or proxy statement and annual report?

We have adopted a procedure approved by the SEC called “householding,” under which we can deliver a single copy of the Notice of Internet Availability and, if applicable, the proxy statement and annual report, to multiple stockholders who share the same address unless we receive contrary instructions from one or more stockholders. This procedure reduces our printing and mailing costs. Stockholders who participate in householding

will continue to be able to access and receive separate proxy cards. Upon written or oral request, we will deliver promptly a separate copy of the Notice of Internet Availability and, if applicable, the proxy statement and annual report, to any stockholder at a shared address to which we delivered a single copy of these documents. To receive a separate copy, or, if you are receiving multiple copies, to request that we only send a single copy of next year’s Notice of Internet Availability or proxy statement and annual report, as applicable, you may contact us as follows:

BlackSky Technology Inc.

Attention: Investor Relations

2411 Dulles Corner Park, Suite 300

Herndon, Virginia 20171

Tel: (571)-267-1571

Street name stockholders may contact their broker, bank or other nominee to request information about householding.

What is BlackSky’s relationship to Osprey Technology Acquisition Corp.?

On September 9, 2021, BlackSky Holdings, Inc. (f/k/a Spaceflight Industries, Inc.) (“Legacy BlackSky”) consummated a business combination (the “merger”) with Osprey Technology Acquisition Corp. (“Osprey”), our legal predecessor and a special purpose acquisition company, whereby Legacy BlackSky became a wholly owned subsidiary of Osprey, and Osprey changed its name to BlackSky Technology Inc., a Delaware corporation (the “Company” or “BlackSky”). Legacy BlackSky was founded in 2014.

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Composition of the Board

Our business and affairs are managed under the direction of our board of directors (the “Board”). Our Board currently consists of seven directors, five of whom are independent under the listing standards of the New York Stock Exchange (“NYSE”).

Our Board is divided into three classes with staggered three-year terms. Only one class of directors is elected at each annual meeting of our stockholders, with the other classes continuing for the remainder of their respective three-year terms. Thus, at each annual meeting of stockholders, a class of directors will be elected for a three-year term to succeed the class whose term is then expiring.

The following table sets forth the names, ages as of July 16, 2024, and certain other information for each of our directors and director nominees. There are no arrangements or understandings between any of our directors and any other person pursuant to which he or she is or was to be selected as a director.

| | | | | | | | | | | | | | | | | | | | |

| Name | Class | Age | Position(s) | Director of Osprey Technology Acquisition Corp. | Director of BlackSky | Current Term Expires |

| Nominees for Director |

|

|

|

|

|

|

| Brian O’Toole | III | 61 | Director | - | September 2021 - Present | 2024 |

James Tolonen(1) (3) | III | 75 | Director | - | September 2021 - Present | 2024 |

| Continuing Directors |

|

|

|

|

|

|

Magid Abraham(2) (3) | I | 66 | Director | - | September 2021 - Present | 2025 |

| David DiDomenico | I | 54 | Director | July 2019 - September 2021 | September 2021 - Present | 2025 |

Susan Gordon(3) | II | 65 | Director | - | September 2021 - Present | 2026 |

Timothy Harvey(1) (2) | II | 68 | Director | - | September 2021 - Present | 2026 |

William Porteous(1) (2) | II | 52 | Director, Chairman | - | September 2021 - Present | 2026 |

(1)Member of the audit committee

(2)Member of the compensation committee

(3)Member of the nominating and corporate governance committee

Nominees for Director

Brian O’Toole has served as President, Chief Executive Officer and a member of our Board since September 2021. Mr. O’Toole became Legacy BlackSky’s President in November 2018 and also assumed chief executive officer duties for BlackSky Global in January 2019 and served in both capacities through the closing of

the merger. Prior to serving as Legacy BlackSky’s President, Mr. O’Toole served as its Chief Technology Officer from June 2016 to November 2018. In addition, Mr. O’Toole served as a member of Legacy BlackSky’s board of directors from January 2019 through the closing of the merger in September 2021. Mr. O’Toole founded and served as the Chief Executive Officer of OpenWhere, Inc., a startup delivering global scale geospatial intelligence solutions to public and private sector customers, from July 2013 to June 2016, when Legacy BlackSky acquired OpenWhere, Inc. Prior to that, Mr. O’Toole served as the Chief Technology Officer of GeoEye Inc. from August 2008 to June 2013 where he led strategic efforts for developing and expanding technology, products, and solutions in geospatial intelligence and location-based services. Mr. O’Toole’s earlier roles include serving as the Vice President of Product Development at Overwatch Systems, founding and serving as the President of ITspatial, and serving as Technical Director and Systems Engineer at GE Aerospace for nine years. Mr. O’Toole received a B.S. in Computer Science from Clarkson University and a M.S. in Computer Engineering from Syracuse University.

Mr. O’Toole was selected to serve as a member of our Board due to his experience and the operational insight he brings as our Chief Executive Officer and President and director on Legacy BlackSky’s board and due to his extensive experience building and growing companies in the geospatial intelligence industry.

James Tolonen has served on our Board since September 2021. Mr. Tolonen served as the Senior Group Vice President and Chief Financial Officer of Business Objects, S.A., an enterprise software solutions provider, where he was responsible for its finance and administration commencing in January 2003 until its acquisition by SAP AG in January 2008. He remained with SAP AG until September 2008. Mr. Tolonen served as the Chief Financial Officer and Chief Operating Officer and a member of the board of directors of IGN Entertainment Inc., an Internet media and service provider, from October 1999 to December 2002. He served as President and Chief Financial Officer of Cybermedia, a PC user security and performance software provider, from April 1998 to September 1998, where he also served as a member of the board of directors from August 1996 to September 1998. Mr. Tolonen served as Chief Financial Officer of Novell, Inc., an enterprise software provider, from June 1989 to April 1998.

Mr. Tolonen previously served on the boards of directors and audit committees of MobileIron, Inc. (2014-2020), Imperva, Inc., (2012-2019), Blue Coat Systems, Inc. (2008-2012), and Taleo Corporation (2010-2012). Mr. Tolonen also previously served on the board of directors of New Relic, Inc. and as the chair of the audit committee and a member of the compensation committee (2016-2022). Mr. Tolonen holds a B.S. in Mechanical Engineering and an M.B.A. from the University of Michigan. Mr. Tolonen is also a Certified Public Accountant, inactive, in the State of California.

Mr. Tolonen was selected to serve as a member of our Board due to his background in accounting, his extensive experience as chief financial officer for a number of public companies, including at several software companies, as well as his involvement on numerous public company audit committees.

Continuing Directors

Dr. Magid Abraham has served on our Board since September 2021. Dr. Abraham is founder and CEO of Neurawell Therapeutics, a pharmaceutical company developing mental health treatments. He was founding CEO of comScore for 14 years, which he took public in 2007, focusing on innovation and industry leadership. He was founder and CEO of Paragren Technologies, producing CRM systems. He was president of IRI, a major international research company, which he led through sustained growth and innovation. He became a Visiting Scholar at Stanford in 2016, where he taught for three years at the Graduate School of Business. He serves on a number of commercial and institutional boards.

Dr. Abraham is a world expert on consumer and market measurement and syndicated information services. He has authored seminal award winning articles. He received the Advertising Research Foundation’s “Lifetime Achievement Award.” He earned the AMA’s Parlin award and MIT’s Buck Weaver award, both in recognition for lifetime contributions and leadership in the theory and practice of Marketing Science. He was named EY Entrepreneur of the Year and inducted in the Entrepreneurship Hall of Fame and designated “Technology Pioneer”

by the World Economic Forum. Dr. Abraham received a Ph.D. and an M.B.A. from MIT, and is engineer of the École Polytechnique, France.

Dr. Abraham was selected to serve as a member of our Board due to his significant executive experience and expertise on market research, consumer modeling and information systems.

David DiDomenico has served on our Board since September 2021 and served on the board of directors of Osprey from July 2019 until the closing of the merger in September 2021. Mr. DiDomenico has been a Partner of JANA Partners, an investment advisor based in New York City, since 2010. Mr. DiDomenico previously served as Osprey’s Chief Executive Officer and President from June 2019 until the closing of the merger in September 2021. He previously served as a Co-Portfolio Manager of JANA’s hedge fund strategies. Prior to joining JANA Partners LLC in 2010, Mr. DiDomenico was a Managing Director of New Mountain Capital and the Portfolio Manager of the New Mountain Vantage Fund (2005-2010). He was previously an Associate Portfolio Manager at Neuberger Berman (2002-2005). From 1999-2002, Mr. DiDomenico was a member of the Acquisitions Team at Starwood Capital Group where he focused on corporate and real estate transactions. From 1998-1999, he was an Analyst at Tiger Management. From October 2019-June 2021, Mr. DiDomenico served on the board of directors of OPENLANE, Inc. (NYSE: KAR), a provider of car auction services in North America and the United Kingdom. He holds an MBA from the Stanford University Graduate School of Business and an AB from Harvard College.

Mr. DiDomenico was selected to serve as a member of our Board due to his experience investing in and analyzing technology and technology-related companies for over 20 years, which we believe provides us with access to his extensive and unique expertise in fundamental business analysis, as well as given his broad professional relationships with technologists and investors.

Hon. Susan M. Gordon has served on our Board since September 2021. The Honorable Susan M. Gordon is a highly respected intelligence professional, visionary leader, and trusted strategic advisor on a broad spectrum of complex issues, including cybersecurity, emerging and disruptive technologies, artificial intelligence, and information operations. Ms. Gordon is the former principal deputy director of national intelligence, the nation’s highest-ranking career intelligence officer. In that capacity, Ms. Gordon managed the operations of the intelligence community and was a key advisor to the President and National Security Council. Prior to her role as principal deputy director of national intelligence, Ms. Gordon served as deputy director of the National Geospatial-Intelligence Agency (NGA). In this position, she provided leadership to the agency and managed the National System of Geospatial Intelligence. Prior to the NGA, she served 27 years at the Central Intelligence Agency (CIA). At the CIA, Ms. Gordon rose to senior executive positions in each of the Agency’s four directorates: operations, analysis, science and technology, and support. Over the course of her career, Ms. Gordon led the establishment of In-Q-Tel, the CIA’s venture arm, and ultimately became the Director’s senior advisor on cyber issues.

Ms. Gordon is the founder and principal of GordonVentures, LLC, a technology, strategy and risk consultancy and currently serves as a consultant and advisor on technology and global risk. Among other endeavors, she is a member of the board of directors of CACI, SecurityScorecard, OneWeb Technologies, Freedom Consulting, and Bridge Core Federal. Ms. Gordon also serves as a Trustee of the Mitre Corporation, is the Vice Chairperson of the National Intelligence University Foundation, and is on the Board of Advisors of the National Security Space Association. Ms. Gordon previously served on the board of directors of Avantus Federal (2020 - 2022). She also serves on several technology advisory boards and consults with Microsoft Corporation. Ms. Gordon is a fellow at Duke and Harvard Universities and she continues to support Defense Department and Intelligence Community study activities. She holds a Bachelor of Science degree in zoology (biomechanics) from Duke University.

Ms. Gordon was selected to serve as a member of our Board due to her expertise and experience with an exemplary history of leadership in the intelligence community.

Timothy Harvey has served on our Board since September 2021. Mr. Harvey has been the Executive Chairman of VTS, Inc., a leasing and asset management platform, since April 2017. Prior to that, from December 2014 to April 2017, he served as President of Commercial Solutions at BAE Systems Plc (“BAE”), a leading global

defense, aerospace and security company. Mr. Harvey joined BAE as a result of BAE’s December 2014 acquisition of SilverSky, a provider of security software and managed services, where he served as CEO and was responsible for the growth and sale of the business to BAE. Mr. Harvey currently serves on the boards of OpenWeb, a social engagement platform, NoFraud, an all-in-one fraud prevention solution, Electric, an information technology company that helps businesses manage their IT security, and Keyfactor, a provider of secure digital identity management solutions. Mr. Harvey graduated with a degree in Finance from the University of Florida and served four years as an officer in the United States Marine Corps.

Mr. Harvey was selected to serve as a member of our Board due to his successful track record of leading market growth coupled with his extensive service on the boards of companies of similar size and scale as BlackSky.

William Porteous has served on our Board since September 2021 and served on Legacy BlackSky’s board of directors from February 2015, and specifically as Chairman of Legacy BlackSky’s board of directors from December 2018, until the closing of the merger in September 2021. Mr. Porteous is a General Partner with RRE Ventures and also serves as the firm’s Chief Operating Officer. During his 23-year career as an investor, Mr. Porteous has served on the boards of more than 20 companies. In addition to serving on our Board, Mr. Porteous also currently serves as a director of Nanit, Paperless Post, Pattern, Pilot Fiber, Spire Global (NYSE: SPIR), Ursa Space Systems, and Wave. From 2010 to 2021, Mr. Porteous also served as a director of Buzzfeed. Mr. Porteous is also Chairman of the Dockery Farms Foundation, which he founded. From 2003 to 2018, Mr. Porteous served as an Adjunct Professor at Columbia Business School where he taught a course on venture capital. Mr. Porteous holds an M.B.A. from Harvard University, an M.Sc. from the London School of Economics, and a B.A. with Honors from Stanford University.

Mr. Porteous was selected to serve as a member of our Board due to his experience at RRE Ventures and his extensive service on the boards of other technology companies.

Director Independence

The NYSE listing standards require that a majority of our board of directors be independent. An “independent director” is generally defined as a person who has no material relationship with the listed company, either directly or as a partner, stockholder or officer of an organization that has a relationship with the company. Our Board has determined that each of Mr. Porteous, Dr. Abraham, Ms. Gordon, Mr. Harvey and Mr. Tolonen, representing five of our seven directors, do not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors is an “independent director” as defined under NYSE listing standards. In making these determinations, our Board considered the current and prior relationships that each non-employee director has with BlackSky and all other facts and circumstances that the Board deemed relevant in determining their independence, including the beneficial ownership of our common stock by each non-employee director, and the transactions involving them. Our independent directors have regularly scheduled meetings at which only independent directors are present.

There are no family relationships among any of our directors, director nominees or executive officers.

Board Leadership Structure

Our corporate governance framework provides our Board flexibility to determine the appropriate leadership structure for the company, and whether the roles of chairperson and chief executive officer should be separated or combined. In making this determination, our Board considers many factors, including the needs of the business, our Board’s assessment of its leadership needs from time to time and the best interests of our stockholders. If the role of chairperson is filled by a director who does not qualify as an independent director, then our corporate governance guidelines provide that one of our independent directors may serve as our lead independent director.

Our Board believes that it is currently appropriate to separate the roles of chairperson and chief executive officer. The chief executive officer is responsible for day-to-day leadership, while our chairperson, along with the

rest of our independent directors, ensures that our Board’s time and attention is focused on providing independent oversight of management and strategic matters critical to our company. The Board believes that Mr. Porteous’s deep knowledge of the company and industry, as well as strong leadership and governance experience, enable Mr. Porteous to lead our Board effectively and independently.

Role of Our Board of Directors in Risk Oversight

One of the key functions of our Board is informed oversight of our risk management process. We have designed and implemented processes to manage risk in our operations. Management is responsible for the day-to-day management of risks the company faces, while our Board, as a whole and assisted by its committees, has responsibility for the oversight of risk management. Our Board reviews strategic and operational risk in the context of discussions, question and answer sessions, and reports from the management team at each regular Board meeting, receives reports on all significant committee activities at each regular Board meeting, and evaluates the risks inherent in significant transactions.

Our Board does not have a standing risk management committee, but rather administers this oversight function directly through the Board as a whole, as well as through various standing committees of our Board that address risks inherent in their respective areas of oversight. Our audit committee is responsible for overseeing the management of risks associated with our financial reporting, accounting and auditing matters, our compensation committee oversees the management of risks associated with our compensation policies and programs, and our nominating and corporate governance committee monitors the effectiveness of our corporate governance guidelines.

Our Board believes its current leadership structure supports the risk oversight function of the Board.

Committees of the Board of Directors

Our Board has established the following standing committees of the board of directors: audit committee; compensation committee; and nominating and corporate governance committee. The composition and responsibilities of each of the committees of our Board is described below.

Audit Committee

We have a standing audit committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The members of our audit committee are Mr. Tolonen, Mr. Porteous and Mr. Harvey. Mr. Tolonen serves as the chairperson of the audit committee. Under the NYSE listing standards and applicable SEC rules, we are required to have at least three members of the audit committee, all of whom must be independent. Each of Mr. Tolonen, Mr. Porteous and Mr. Harvey qualify as an independent director for audit committee purposes under the applicable rules.

Each member of the audit committee meets the financial literacy requirements of the NYSE listing standards, and Mr. Tolonen qualifies as an “audit committee financial expert” as defined in applicable SEC rules.

The purpose of the audit committee is to prepare the audit committee report required by the SEC to be included in our proxy statement and to assist our Board in overseeing and monitoring (i) the quality and integrity of our financial statements, (ii) our compliance with legal and regulatory requirements, (iii) our independent registered public accounting firm’s qualifications and independence, (iv) the performance of our internal audit function and (v) the performance of our independent registered public accounting firm.

The functions of the audit committee include, among other things:

•evaluating the performance, independence and qualifications of our independent auditors and determining whether to retain our existing independent auditors or engage new independent auditors;

•reviewing our financial reporting processes and disclosure controls;

•reviewing and approving the engagement of our independent auditors to perform audit services and any permissible non-audit services;

•reviewing the adequacy and effectiveness of our internal control policies and procedures, including the responsibilities, budget, staffing and effectiveness of our internal audit function;

•obtaining and reviewing at least annually a report by our independent auditors describing the independent auditors’ internal quality control procedures and any material issues raised by the most recent internal quality control review;

•monitoring the rotation of partners of our independent auditors on our engagement team as required by law;

•prior to engagement of any independent auditor, and at least annually thereafter, reviewing relationships that may reasonably be thought to bear on their independence, and assessing and otherwise taking the appropriate action to oversee the independence of our independent auditor;

•reviewing our annual and quarterly financial statements and annual and quarterly reports on Form 10-K and 10-Q, and discussing the statements and reports with our independent auditors and management;

•reviewing with our independent auditors and management significant issues that arise regarding accounting principles and financial statement presentation and matters concerning the scope, adequacy, and effectiveness of our financial controls and critical accounting policies;

•reviewing with management and our auditors any earnings announcements and other public announcements regarding material developments;

•establishing procedures for the receipt, retention and treatment of complaints received by us regarding financial controls, accounting, auditing or other matters;

•preparing the report that the SEC requires in our annual proxy statement;

•reviewing and providing oversight of any related party transactions in accordance with our related party transaction policy and reviewing and monitoring compliance with legal and regulatory responsibilities, including our code of business conduct;

•reviewing our major financial risk exposures, including the guidelines and policies to govern the process by which risk assessment and risk management is implemented; and

•reviewing and evaluating on an annual basis the performance of the audit committee and the audit committee charter.

Our Board adopted a written charter for the audit committee, which is available on our website at https://ir.blacksky.com/governance/governance-documents. During 2023, our audit committee held seven meetings.

Compensation Committee

The members of our compensation committee are Mr. Porteous, Mr. Harvey and Dr. Abraham. Mr. Harvey serves as the chairperson of the compensation committee. Under the NYSE listing standards and applicable SEC rules, we are required to have at least two members of the compensation committee, all of whom must be independent. Each of Mr. Porteous, Mr. Harvey and Dr. Abraham qualify as an independent director for compensation committee purposes under the applicable rules.

The purpose of the compensation committee is to assist our Board in discharging its responsibilities relating to (i) setting our compensation program and compensation of our executive officers and directors and (ii) monitoring our incentive and equity-based compensation plans.

Our Board adopted a written charter for the compensation committee, which is available on our website at https://ir.blacksky.com/governance/governance-documents. During 2023, our compensation committee held 10 meetings.

Nominating and Corporate Governance Committee

The members of our nominating and corporate governance committee are Dr. Abraham, Ms. Gordon and Mr. Tolonen. Dr. Abraham serves as chairperson of the nominating and corporate governance committee.

The primary purposes of our nominating and corporate governance committee are to assist our Board in: (i) identifying individuals qualified to become new Board members, consistent with criteria approved by the Board, (ii) reviewing the qualifications of incumbent directors to determine whether to recommend them for reelection and selecting, or recommending that the Board select, the director nominees for the next annual meeting of stockholders, (iii) identifying members of the Board qualified to fill vacancies on any Board committee and recommending that the Board appoint the identified member or members to the applicable committee, (iv) reviewing and recommending to the Board corporate governance principles applicable to us, (v) overseeing the evaluation of the Board and (vi) handling such other matters that are specifically delegated to the committee by the Board from time to time.

Our Board adopted a written charter for the nominating and corporate governance committee, which is available on our website at https://ir.blacksky.com/governance/governance-documents. During 2023, our nominating and corporate governance committee held five meetings.

Attendance at Board and Stockholder Meetings

During our fiscal year ended December 31, 2023, our board of directors held 14 meetings (including regularly scheduled and special meetings) and each director attended at least 75% of the aggregate of (1) the total number of meetings of the Board held during the fiscal year, and (2) the total number of meetings held by all committees on which he or she served.

Although we do not have a formal policy regarding attendance by members of our Board at the annual meetings of stockholders, we encourage, but do not require, directors to attend. Each of our seven directors attended our 2023 annual meeting of stockholders.

Compensation Committee Interlocks and Insider Participation

During our fiscal year ended December 31, 2023, the members of our compensation committee were Mr. Porteous, Mr. Harvey and Dr. Abraham. No member of our compensation committee is or has been an officer or employee of the Company. None of our executive officers currently serves, or served during our fiscal year ended December 31, 2023, as a member of the board of directors or compensation committee of any entity that has one or more executive officers that serves as a member of our Board or compensation committee.

Executive Sessions of Non-Employee Directors

To encourage and enhance communication among non-employee directors, and as required under applicable NYSE rules, our corporate governance guidelines provide that the non-employee directors will meet in executive sessions without management directors or management present on a periodic basis. In addition, if any of our non-employee directors are not independent directors, then our independent directors will also meet in executive session on a periodic basis. Mr. Porteous, the Chairman of the Board, presides at all such executive sessions.

Considerations in Evaluating Director Nominees

Our nominating and corporate governance committee uses a variety of methods for identifying and evaluating potential director nominees. In its evaluation of director candidates, including the current directors eligible for re-election, our nominating and corporate governance committee will consider the current size and composition of our board of directors and the needs of our Board and the respective committees of our Board and other director qualifications. While our Board has not established minimum qualifications for Board members, some of the factors that our nominating and corporate governance committee considers in assessing director nominee qualifications include, without limitation, issues of character, professional ethics and integrity, judgment, business acumen, proven achievement and competence in one’s field, the ability to exercise sound business judgment, tenure on our Board and skills that are complementary to our Board, an understanding of our business, an understanding of the responsibilities that are required of a member of our Board, other time commitments, and diversity, and with respect to diversity, such factors as race, ethnicity, gender, differences in professional background, education, age and geography, as well as other individual qualities and attributes that contribute to the total mix of viewpoints and experience represented on our Board. Although our Board does not maintain a specific policy with respect to Board diversity, our Board believes that the Board should be a diverse body, and the nominating and corporate governance committee considers a broad range of perspectives, backgrounds and experiences.

If our nominating and corporate governance committee determines that an additional or replacement director is required, then the committee may take such measures as it considers appropriate in connection with its evaluation of a director candidate, including candidate interviews, inquiry of the person or persons making the recommendation or nomination, engagement of an outside search firm to gather additional information, or reliance on the knowledge of the members of the committee, Board or management.

After completing its review and evaluation of director candidates, our nominating and corporate governance committee recommends to our full board of directors the director nominees for selection. Our nominating and corporate governance committee has discretion to decide which individuals to recommend for nomination as directors and our Board has the final authority in determining the selection of director candidates for nomination to our Board.

Stockholder Recommendations and Nominations to our Board of Directors

Our nominating and corporate governance committee will consider recommendations and nominations for candidates to our board of directors from stockholders in the same manner as candidates recommended to the committee from other sources, as long as such recommendations and nominations comply with our amended and restated certificate of incorporation and amended and restated bylaws, all applicable company policies and all applicable laws, rules and regulations, including those promulgated by the SEC. Our nominating and corporate governance committee will evaluate such recommendations in accordance with its charter, our amended and restated bylaws and corporate governance guidelines and the director nominee criteria described above.

A stockholder that wants to recommend a candidate to our board of directors should direct the recommendation in writing by letter to our corporate secretary at BlackSky Technology Inc., Attn: Corporate Secretary, 2411 Dulles Corner Park, Suite 300, Herndon, Virginia 20171. Such recommendation must include the candidate’s name, home and business contact information, detailed biographical data, relevant qualifications, a signed letter from the candidate confirming willingness to serve, information regarding any relationships between the candidate and us and evidence of the recommending stockholder’s ownership of our capital stock. Such

recommendation must also include a statement from the recommending stockholder in support of the candidate, particularly within the context of the criteria for Board membership, including issues of character, integrity, judgment, diversity of experience, independence, area of expertise, corporate experience, length of service, potential conflicts of interest, other commitments and the like and personal references.

To be timely, a stockholder’s recommendations must be received by our corporate secretary at our principal executive offices no later than December 31 of the year prior to the year in which any recommended candidates will be considered for nomination.

Our nominating and corporate governance committee has discretion to decide which individuals to recommend for nomination as directors.

Under our amended and restated bylaws, stockholders may also directly nominate persons for our board of directors. Any nomination must comply with the requirements set forth in our amended and restated bylaws and the rules and regulations of the SEC and should be sent in writing to our corporate secretary at the address above. To be timely for our 2025 annual meeting of stockholders, nominations must be received by our corporate secretary observing the deadlines discussed below under “Other Matters—Stockholder Proposals or Director Nominations for 2025 Annual Meeting.”

Communications with the Board of Directors

Stockholders and other interested parties wishing to communicate directly with our non-management directors may do so by writing and sending the correspondence to our General Counsel by mail to our principal executive offices at BlackSky Technology Inc., 13241 Woodland Park Road, Suite 300, Herndon, Virginia 20171 (through August 31, 2024) or 2411 Dulles Corner Park, Suite 300, Herndon, Virginia 20171 (effective September 1, 2024). Our General Counsel, in consultation with appropriate directors as necessary, will review all incoming communications and screen for communications that (1) are solicitations for products and services, (2) relate to matters of a personal nature not relevant for our stockholders to act on or for our Board to consider and (3) matters that are of a type that are improper or irrelevant to the functioning of our Board or our business, for example, mass mailings, job inquiries and business solicitations. If appropriate, our General Counsel will route such communications to the appropriate director(s) or, if none is specified, then to the chairperson of the Board. These policies and procedures do not apply to communications to non-management directors from our officers or directors who are stockholders or stockholder proposals submitted pursuant to Rule 14a-8 under the Exchange Act.

Policy Prohibiting Hedging or Pledging of Securities

Under our insider trading policy, our employees, including our executive officers, and the members of our board of directors are prohibited from, directly or indirectly, among other things, (1) engaging in short sales, (2) trading in publicly-traded options, such as puts and calls, and other derivative securities with respect to our securities (other than stock options, restricted stock units and other compensatory awards issued to such individuals by us), (3) purchasing financial instruments (including prepaid variable forward contracts, equity swaps, collars and exchange funds), or otherwise engaging in transactions that hedge or offset, or are designed to hedge or offset, any decrease in the market value of equity securities granted to them by us as part of their compensation or held, directly or indirectly, by them, (4) pledging any of our securities as collateral for any loans and (5) holding our securities in a margin account.

Corporate Governance Guidelines and Code of Business Conduct and Ethics

Our board of directors adopted corporate governance guidelines in accordance with the corporate governance rules of the NYSE that serve as a framework within which our Board and its committees operate. These guidelines cover a number of areas including Board membership criteria and director qualifications, director responsibilities, Board agenda, roles of the chair of the Board, principal executive officer and presiding director, meetings of independent directors, committee responsibilities and assignments, Board member access to management and independent advisors, director communications with third parties, director compensation, director orientation and continuing education, evaluation of senior management and management succession planning.

Our Board adopted a code of business conduct and ethics that applies to all of our directors, officers and employees, including our chief executive officer and chief financial officer. Our code of business conduct and ethics is a “code of ethics,” as defined in Item 406(b) of Regulation S-K.

The full text of our corporate governance guidelines and code of business conduct and ethics are available on our website at https://ir.blacksky.com/governance/governance-documents. We will post amendments to our code of business conduct and ethics or any waivers of our code of business conduct and ethics for directors and executive officers on the same website.

Director Compensation

Each non-employee director is eligible to receive compensation for their service consisting of annual cash retainers and equity awards under our outside director compensation policy (the “Outside Director Compensation Policy”), which became effective in connection with the closing of the merger in September 2021. The Outside Director Compensation Policy is designed to align the interests of the non-employee directors with the interests of stockholders through equity awards and to attract and retain high quality non-employee directors by providing competitive compensation. On March 6, 2023, our Board adopted an amended outside director compensation policy (the “Amended Outside Director Compensation Policy”) to permit directors to elect to receive their annual cash retainer in BlackSky stock instead of cash. All compensation paid to our non-employee directors for fiscal year 2023 was pursuant to the terms of the Outside Director Compensation Policy adopted at the time of the merger, or the Amended Outside Director Compensation Policy upon and after adoption of such amended policy.

Cash Compensation

The Amended Outside Director Compensation Policy provides for an annual cash retainer of $90,000, which is payable quarterly in arrears on a prorated basis. There are no additional retainers for service as a member (or chairperson) of a committee of our Board, as chairperson of our Board, or as lead director and no per-meeting attendance fees for attending meetings of our Board or any of our committees. Pursuant to the Amended Outside Director Compensation Policy, beginning in the third quarter of 2023, directors who elect to receive the annual retainer in shares of our common stock, instead of cash, will receive such retainer in shares of our stock.

Equity Compensation

Initial Award. Pursuant to the Amended Outside Director Compensation Policy, each individual who becomes a non-employee director will receive, on the first trading day on or after the date that the individual first becomes a non-employee director, an initial award (the “Initial Award”) of restricted stock units with a grant date fair value equal to $300,000. The Initial Award will be scheduled to vest as to one-third of the shares subject to the Initial Award on each of the one-, two-, and three-year anniversaries of the Initial Award’s grant date, subject to continued service through the applicable vesting dates. If the person was a member of our Board and also an employee, becoming a non-employee director due to termination of employment will not entitle the individual to an Initial Award.

Annual Award. Pursuant to the Amended Outside Director Compensation Policy, each non-employee director automatically will receive, on the first trading day immediately after the date of each annual meeting of our

stockholders, an annual award (the “Annual Award”) of restricted stock units covering a number of shares of our common stock having a grant date fair value of $150,000, provided that such individual, as of the date of an annual meeting of our stockholders, has served as a non-employee director for at least six months. Each Annual Award will be scheduled to vest as to all of the shares subject to the Annual Award on the one-year anniversary of the Annual Award’s grant date, or if earlier, the day of the next annual meeting of stockholders that occurs after the grant date of the Annual Award, subject to continued service through such vesting date.

Other Initial Award and Annual Award Terms. Each Initial Award and Annual Award will be granted under the 2021 Equity Incentive Plan (the “2021 Plan”) (or its successor plan, as applicable) and form of award agreement under such plan. For purposes of each Initial Award and Annual Award, the award’s grant date fair value will be determined in accordance with U.S. Generally Accepted Accounting Principles.

Change in Control. In the event of a change in control, as defined in the 2021 Plan (or its successor plan, as applicable), each non-employee director’s then-outstanding equity awards covering shares of our common stock that were granted to them while a non-employee director will accelerate vesting in full, provided that they remain a non-employee director through the date of the change in control.

Director Compensation Limits. The Amended Outside Director Compensation Policy provides that in any fiscal year, a non-employee director may not be granted equity awards, the value of which will be based on their grant date fair value determined in accordance with U.S. Generally Accepted Accounting Principles, and be provided any other compensation (including without limitation any cash retainers or fees) in amounts that, in any fiscal year, in the aggregate, exceed $500,000, provided that in the fiscal year of the individual’s initial service as a non-employee director, such amount will be increased to $800,000. Equity awards granted or other compensation provided to an individual for their services as employee, or for their services as a consultant (other than as a non-employee director), will not count toward this annual limit.

Director Compensation for Fiscal Year 2023

The following table sets forth information regarding the total compensation awarded to, earned by or paid to our non-employee directors for their service on our Board, for the fiscal year ended December 31, 2023. Directors who are also our employees receive no additional compensation for their service as directors. During 2023, Mr. O’Toole was an employee and executive officer of the Company and, therefore, did not receive compensation as a director. See “Executive Compensation” below for additional information regarding Mr. O’Toole’s compensation.

Pursuant to the Amended Outside Director Compensation Policy, our directors could elect to receive their annual cash retainer in shares of our common stock instead of cash effective for the third and fourth quarters of 2023. The amounts reflected below under the column titled “Fees Paid or Earned in Cash” include the annual retainer as either cash or common stock in lieu of cash.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| | | |

| Name | Fees Paid or Earned in Cash ($)(1) | Stock Awards ($)(2) | Total ($) |

| William Porteous | 90,000 | 150,000 | 240,000 |

| Magid Abraham | 90,000 | 150,000 | 240,000 |

| David DiDomenico | 90,000 | 150,000 | 240,000 |

| Susan Gordon | 90,000 | 150,000 | 240,000 |

| Timothy Harvey | 90,000 | 150,000 | 240,000 |

| James Tolonen | 90,000 | 150,000 | 240,000 |

_____________________

(1)Pursuant to the Amended Outside Director Compensation Policy, Mr. Porteous, Dr. Abraham, Ms. Gordon, Mr. Harvey, and Mr. Tolonen each elected to receive their retainer fees for the third and fourth quarters of 2023, valuing $45,000 in total, in shares of our common stock, instead of cash, and, as a result, were each granted 19,230 restricted stock units on September 30, 2023 and 16,071 restricted stock units on December 31, 2023, all of which were 100% vested on the date of grant.

Amounts in this column include the $45,000 in retainer fees received in the form of shares of our common stock for each of Mr. Porteous, Dr. Abraham, Ms. Gordon, Mr. Harvey, and Mr. Tolonen. Please see “Director Compensation” and “Cash Compensation” above for information regarding the Amended Outside Director Compensation Policy.

(2)The following table lists all outstanding stock awards held by non-employee directors as of December 31, 2023:

| | | | | | | | | | | | | | | | | |

| | | | | |

| Name | Number of Shares Underlying Outstanding Stock Awards |

| William Porteous | 130,908 |

| Magid Abraham | 130,908 |

| David DiDomenico | 130,908 |

| Susan Gordon | 130,908 |

| Timothy Harvey | 130,908 |

| James Tolonen | 130,908 |

PROPOSAL NO. 1:

ELECTION OF CLASS III DIRECTORS

Our board of directors currently consists of seven directors and is divided into three classes with staggered three-year terms. At the annual meeting, two Class III directors, Brian O’Toole and James Tolonen, will be elected for a three-year term to succeed the same class whose term is then expiring. Each director’s term continues until the expiration of the term for which such director was elected and until such director’s successor is elected and qualified or until such director’s earlier death, resignation or removal.

Nominees

Our nominating and corporate governance committee has recommended, and our board of directors has approved, Messrs. O’Toole and Tolonen as nominees for election as Class III directors at the annual meeting. If elected, each of Messrs. O’Toole and Tolonen will serve as a Class III director until the 2027 annual meeting of stockholders and until his respective successor is elected and qualified or until his earlier death, resignation or removal. For more information concerning the nominees, please see the section titled “Board of Directors and Corporate Governance.”

Messrs. O’Toole and Tolonen have agreed to serve as directors if elected, and management has no reason to believe that they will be unavailable to serve. In the event a nominee is unable or declines to serve as a director at the time of the annual meeting, proxies will be voted for any nominee designated by the present board of directors to fill the vacancy.

Vote Required

Each director is elected by a plurality of the voting power of the shares present virtually or represented by proxy at the meeting and entitled to vote on the election of directors. Because the outcome of this proposal will be determined by a plurality vote, any shares not voted FOR a particular nominee, whether as a result of choosing to WITHHOLD authority to vote or a broker non-vote, will have no effect on the outcome of the election.

Board Recommendation

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH OF THE DIRECTOR NOMINEES NAMED ABOVE.

PROPOSAL NO. 2:

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

Our audit committee has appointed Deloitte & Touche LLP (“Deloitte”) as our independent registered public accounting firm to audit our consolidated financial statements for our fiscal year ending December 31, 2024. Deloitte served as our independent registered public accounting firm for the fiscal year ended December 31, 2023.