UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): September 1, 2021

Osprey Technology Acquisition Corp.

(Exact name of registrant as specified in its charter)

| Delaware | 001-39113 | 83-1833760 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

| 1845 Walnut Street, Suite 1111 Philadelphia, PA |

19103 | |

| (Address of principal executive offices) | (Zip Code) |

(212) 920-1345

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading |

Name of each exchange | ||

| Class A common stock, par value $0.0001 per share | SFTW | New York Stock Exchange | ||

| Warrants, each to purchase one share of Class A common stock | SFTW.WS | New York Stock Exchange | ||

| Units, each consisting of one share of Class A common stock, $0.0001 par value per share, and one-half of one redeemable warrant | SFTW.U | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

Furnished as Exhibit 99.1 hereto is an investor presentation dated September 2021 (the “Investor Presentation”), which will be used by BlackSky Holdings, Inc. (“BlackSky”) in a presentation to investors with respect to the proposed transactions between Osprey Technology Acquisition Corp. (the “Company”) and BlackSky.

The information in this Item 7.01, including Exhibit 99.1, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise be subject to liabilities under that section, and shall not be deemed to be incorporated by reference into any filings of the Company under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, regardless of any general incorporation language in such filings. This Current Report on Form 8-K (the “Current Report”) shall not be deemed an admission as to the materiality of any information in this Item 7.01, including Exhibit 99.1.

Additional Information and Where to Find It

This document relates to the proposed transactions between the Company and BlackSky. In connection with the business combination, on May 13, 2021, the Company filed a registration statement on Form S-4 with the U.S. Securities and Exchange Commission (the “SEC”), as amended on June 25, 2021, July 14, 2021, and August 2, 2021, which includes a document that serves as a prospectus and proxy statement of the Company, referred to as a proxy statement/prospectus. In connection with the proposed business combination, on August 11, 2021, the Company filed with the SEC a definitive proxy statement/prospectus. The Company commenced mailing the definitive proxy statement/prospectus to its stockholders on August 11, 2021. A proxy statement/prospectus will be sent to all stockholders of the Company. The Company also will file other documents regarding the proposed transactions with the SEC. Before making any voting or investment decision, investors and security holders of the Company are urged to read the registration statement, the proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC in connection with the proposed transactions as they become available because they will contain important information about the proposed transactions.

Investors and security holders may obtain free copies of the registration statement, the proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC by the Company through the website maintained by the SEC at www.sec.gov.

The documents filed by the Company with the SEC also may be obtained free of charge at the Company’s website at https://www.osprey-technology.com/ or from the Company upon written request to 1845 Walnut Street, Suite 1111, Philadelphia, Pennsylvania 19103.

Participants in Solicitation

The Company and BlackSky and their directors and executive officers may be deemed to be participants in the solicitation of proxies from Company stockholders in connection with the previously announced proposed transactions with BlackSky. The Company’s stockholders and other interested persons may obtain, without charge, more detailed information regarding the directors and officers of the Company in the Company’s Annual Report on Form 10-K/A for the fiscal year ended December 31, 2020, which was filed with the SEC on May 12, 2021, and in the Company’s registration statement on Form S-4, which was filed by the Company with the SEC in connection with the business combination on May 13, 2021. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies to the Company’s shareholders in connection with the proposed business combination is set forth in the proxy statement/prospectus on Form S-4 for the proposed business combination, which was filed by the Company with the SEC on May 13, 2021, as amended on June 25, 2021, July 14, 2021, and August 2, 2021, in connection with the business combination.

A list of the names of such directors and executive officers and information regarding their interests in the transactions are or will be contained in the proxy statement/prospectus when available. You may obtain free copies of these documents as described in the preceding paragraph.

2

This document does not constitute an offer to sell or exchange, or the solicitation of an offer to buy or exchange, any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, sale or exchange would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

Forward-Looking Statements Legend

This Current Report on Form 8-K contains certain forward-looking statements within the meaning of the federal securities laws. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this document. You should carefully consider the risks and uncertainties described in the “Risk Factors” section of the Company’s registration on Form S-1 (File No. 333-234180), the registration statement on Form S-4 discussed above and other documents filed by the Company from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and the Company and BlackSky assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Neither the Company nor BlackSky gives any assurance that either BlackSky or the Company, or the combined company, will achieve its expectations.

Non-GAAP Financial Measures and Related Information

Exhibit 99.1 to this Current Report on Form 8-K references EBITDA, Adjusted EBITDA, Adjusted EBITDA margin, free cash flow and free cash flow conversion, which are financial measures that are not prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). These non-GAAP financial measures do not have a standardized meaning, and the definitions of these measures used by BlackSky may be different from other, similarly named non-GAAP measures used by others. In addition, such financial information is unaudited and does not conform to SEC Regulation S-X and as a result such information may be presented differently in future filings by BlackSky or the Company with the SEC.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| Exhibit No. |

Description | |

| 99.1 | Investor Presentation. | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |

3

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Osprey Technology Acquisition Corp. | ||||||

| Date: September 1, 2021 | ||||||

| By: | /s/ Jeffrey Brotman | |||||

| Name: Jeffrey Brotman | ||||||

| Title: Chief Financial Officer, Chief Legal Officer and Secretary | ||||||

4

Exhibit 99.1 S E P T E M B E R 2021 INVESTOR PRESENTATION 1Exhibit 99.1 S E P T E M B E R 2021 INVESTOR PRESENTATION 1

Confidentiality, Proprietary Information, and Forward Looking Statements Confidentiality and Disclosures. This presentation has been prepared for use by Osprey Technology Acquisition Corp. (“Osprey”) and BlackSky Holdings, Inc. (“BlackSky”) in connection with their proposed business combination. This presentation is for information purposes only and is being provided to assist interested parties in making their own evaluation with respect to a potential business combination between Osprey and BlackSky and related transactions and may not be reproduced or redistributed, in whole or in part, without the prior written consent of Osprey and BlackSky. Neither Osprey nor BlackSky makes any representation or warranty as to the accuracy or completeness of the information contained in this presentation. The information in this presentation and any oral statements made in connection with this presentation are subject to change and are not intended to be all-inclusive or to contain all the information that a person may desire when evaluating the transactions contemplated in this presentation. . This presentation does not constitute either advise or a recommendation regarding any securities. This presentation and any oral statements made in connection with this presentation shall neither constitute an offer to sell nor the solicitation of an offer to buy any securities, or the solicitation of any proxy, vote, consent or approval in any jurisdiction in connection with the proposed business combination, nor shall there be any sale of securities in any jurisdiction in which the offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdictions. Any offer to sell securities will be made only pursuant to a definitive Subscription Agreement and will be made in reliance on an exemption from registration under the Securities Act of 1933, as amended, for offers and sales of securities that do not involve a public offering. Osprey and BlackSky reserve the right to withdraw or amend for any reason any offering and to reject any Subscription Agreement for any reason. This communication is restricted by law; it is not intended for distribution to, or use by any person in, any jurisdiction where such distribution or use would be contrary to local law or regulation. Forward-Looking Statements. Certain statements in this presentation may constitute “forward-looking statements” within the meaning of the federal securities laws. Forward-looking statements include, but are not limited to, statements regarding Osprey’s or BlackSky’s expectations, hopes, beliefs, intentions or strategies regarding the future including, without limitation, statements regarding: (i) the size, demands and growth potential of the markets for BlackSky’s products and BlackSky’s ability to serve those markets, (ii) the degree of market acceptance and adoption of BlackSky’s products, (iii) BlackSky’s ability to develop innovative products and compete with other companies engaged in the space technology industry, (iv) BlackSky’s ability to attract customers and maintain relationships, and (v) the implied upside and implied valuation of BlackSky. In addition, any statements that refer to projections, forecasts, or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipate,” “believe,” continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “strive,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that statement is not forward-looking. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. You should carefully consider the risks and uncertainties described in the “Risk Factors” section of Osprey’s registration statement on Form S-1, the proxy statement/prospectus on Form S-4 relating to the business combination, which was filed by Osprey on May 13, 2021 as amended on August 2, 2021, with the Securities and Exchange Commission (the “SEC”), the final proxy statement filed on August 11, 2021 with the SEC, and other documents filed by Osprey from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Osprey and BlackSky assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Neither Osprey nor BlackSky gives any assurance that either Osprey or BlackSky will achieve its expectations. Use of Projections. The financial projections, estimates and targets in this presentation are forward-looking statements that are based on assumptions that are inherently subject to significant uncertainties and contingencies, many of which are beyond Osprey’s and BlackSky’s control. While all financial projections, estimates and targets are necessarily speculative, Osprey and BlackSky believe that the preparation of prospective financial information involves increasingly higher levels of uncertainty the further out the projection, estimate or target extends from the date of preparation. The assumptions and estimates underlying the projected, expected or target results are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the financial projections, estimates and targets. The inclusion of financial projections, estimates and targets in this presentation should not be regarded as an indication that Osprey and BlackSky, or their representatives, considered or consider the financial projections, estimates and targets to be a reliable prediction of future events. Use of Data. The data contained herein is derived from various internal and external sources. All of the market data in the presentation involves a number of assumptions and limitations, and there can be no guarantee as to the accuracy or reliability of such assumptions. Further, no representation is made as to the reasonableness of the assumptions made within or the accuracy or completeness of any projections or modeling or any other information contained herein. Any data on past performance or modeling contained herein is not an indication as to future performance. Osprey and BlackSky assume no obligation to update the information in this presentation. Further, the BlackSky 2019 financial data included in this presentation were audited in accordance with private company AICPA standards. Accordingly, such information and data may not be included, may be adjusted, or may be presented differently, in any proxy statement/prospectus to be filed with the SEC. In addition, this presentation includes estimates of certain financial metrics of BlackSky that may differ from BlackSky’s actual financial metrics presented in any such proxy statement/prospectus. BlackSky is currently in the process of uplifting its financials to comply with public company and SEC requirements. Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 2Confidentiality, Proprietary Information, and Forward Looking Statements Confidentiality and Disclosures. This presentation has been prepared for use by Osprey Technology Acquisition Corp. (“Osprey”) and BlackSky Holdings, Inc. (“BlackSky”) in connection with their proposed business combination. This presentation is for information purposes only and is being provided to assist interested parties in making their own evaluation with respect to a potential business combination between Osprey and BlackSky and related transactions and may not be reproduced or redistributed, in whole or in part, without the prior written consent of Osprey and BlackSky. Neither Osprey nor BlackSky makes any representation or warranty as to the accuracy or completeness of the information contained in this presentation. The information in this presentation and any oral statements made in connection with this presentation are subject to change and are not intended to be all-inclusive or to contain all the information that a person may desire when evaluating the transactions contemplated in this presentation. . This presentation does not constitute either advise or a recommendation regarding any securities. This presentation and any oral statements made in connection with this presentation shall neither constitute an offer to sell nor the solicitation of an offer to buy any securities, or the solicitation of any proxy, vote, consent or approval in any jurisdiction in connection with the proposed business combination, nor shall there be any sale of securities in any jurisdiction in which the offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdictions. Any offer to sell securities will be made only pursuant to a definitive Subscription Agreement and will be made in reliance on an exemption from registration under the Securities Act of 1933, as amended, for offers and sales of securities that do not involve a public offering. Osprey and BlackSky reserve the right to withdraw or amend for any reason any offering and to reject any Subscription Agreement for any reason. This communication is restricted by law; it is not intended for distribution to, or use by any person in, any jurisdiction where such distribution or use would be contrary to local law or regulation. Forward-Looking Statements. Certain statements in this presentation may constitute “forward-looking statements” within the meaning of the federal securities laws. Forward-looking statements include, but are not limited to, statements regarding Osprey’s or BlackSky’s expectations, hopes, beliefs, intentions or strategies regarding the future including, without limitation, statements regarding: (i) the size, demands and growth potential of the markets for BlackSky’s products and BlackSky’s ability to serve those markets, (ii) the degree of market acceptance and adoption of BlackSky’s products, (iii) BlackSky’s ability to develop innovative products and compete with other companies engaged in the space technology industry, (iv) BlackSky’s ability to attract customers and maintain relationships, and (v) the implied upside and implied valuation of BlackSky. In addition, any statements that refer to projections, forecasts, or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipate,” “believe,” continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “strive,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that statement is not forward-looking. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. You should carefully consider the risks and uncertainties described in the “Risk Factors” section of Osprey’s registration statement on Form S-1, the proxy statement/prospectus on Form S-4 relating to the business combination, which was filed by Osprey on May 13, 2021 as amended on August 2, 2021, with the Securities and Exchange Commission (the “SEC”), the final proxy statement filed on August 11, 2021 with the SEC, and other documents filed by Osprey from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Osprey and BlackSky assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Neither Osprey nor BlackSky gives any assurance that either Osprey or BlackSky will achieve its expectations. Use of Projections. The financial projections, estimates and targets in this presentation are forward-looking statements that are based on assumptions that are inherently subject to significant uncertainties and contingencies, many of which are beyond Osprey’s and BlackSky’s control. While all financial projections, estimates and targets are necessarily speculative, Osprey and BlackSky believe that the preparation of prospective financial information involves increasingly higher levels of uncertainty the further out the projection, estimate or target extends from the date of preparation. The assumptions and estimates underlying the projected, expected or target results are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the financial projections, estimates and targets. The inclusion of financial projections, estimates and targets in this presentation should not be regarded as an indication that Osprey and BlackSky, or their representatives, considered or consider the financial projections, estimates and targets to be a reliable prediction of future events. Use of Data. The data contained herein is derived from various internal and external sources. All of the market data in the presentation involves a number of assumptions and limitations, and there can be no guarantee as to the accuracy or reliability of such assumptions. Further, no representation is made as to the reasonableness of the assumptions made within or the accuracy or completeness of any projections or modeling or any other information contained herein. Any data on past performance or modeling contained herein is not an indication as to future performance. Osprey and BlackSky assume no obligation to update the information in this presentation. Further, the BlackSky 2019 financial data included in this presentation were audited in accordance with private company AICPA standards. Accordingly, such information and data may not be included, may be adjusted, or may be presented differently, in any proxy statement/prospectus to be filed with the SEC. In addition, this presentation includes estimates of certain financial metrics of BlackSky that may differ from BlackSky’s actual financial metrics presented in any such proxy statement/prospectus. BlackSky is currently in the process of uplifting its financials to comply with public company and SEC requirements. Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 2

Confidentiality, Proprietary Information, and Forward Looking Statements (cont.) Use of Non-GAAP Financial Metrics. This presentation includes certain non-GAAP financial measures (including on a forward-looking basis) such as Adjusted EBITDA. These non-GAAP measures are an addition, and not a substitute for or superior to, measures of financial performance prepared in accordance with GAAP and should not be considered as an alternative to net income, operating income or any other performance measures derived in accordance with GAAP. Reconciliations of non- GAAP measures to their most directly comparable GAAP counterparts are included in the Appendix to this presentation. BlackSky believes that these non-GAAP measures of financial results (including on a forward-looking basis) provide useful supplemental information to investors about BlackSky. BlackSky’s management uses forward-looking non-GAAP measures to evaluate BlackSky’s projected financials and operating performance. However, there are a number of limitations related to the use of these non-GAAP measures and their nearest GAAP equivalents, including that they exclude significant expenses that are required by GAAP to be recorded in BlackSky’s financial measures. In addition, other companies may calculate non- GAAP measures differently, or may use other measures to calculate their financial performance, and therefore, BlackSky’s non-GAAP measures may not be directly comparable to similarly titled measures of other companies. Additionally, to the extent that forward-looking non-GAAP financial measures are provided, they are presented on a non-GAAP basis without reconciliations of such forward-looking non-GAAP measures due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliations. Trademarks. Osprey and BlackSky own or have rights to various trademarks, service marks and trade names that they use in connection with the operation of their respective businesses. This presentation may also contain trademarks, service marks, trade names and copyrights of third parties, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade names or products in this presentation is not intended to, and does not imply, a relationship with Osprey or BlackSky, or an endorsement or sponsorship by or of Osprey or BlackSky. Solely for convenience, the trademarks, service marks, trade names and copyrights referred to in this presentation may appear without the TM, SM, ® or © symbols, but such references are not intended to indicate, in any way, that Osprey or BlackSky will not assert, to the fullest extent under applicable law, their rights or the right of the applicable licensor to these trademarks, service marks, trade names and copyrights. Participation in Solicitation. Osprey and BlackSky and their respective directors and executive officers, under SEC rules, may be deemed to be participants in the solicitation of proxies of Osprey’s shareholders in connection with the proposed business combination. Investors and security holders may obtain more detailed information regarding the names and interests in the proposed business combination of Osprey’s directors and officers in Osprey’s filings with the SEC, including Osprey’s registration statement on Form S-1, which was originally filed with the SEC on October 31, 2019. To the extent that holdings of Osprey’s securities have changed from the amounts reported in Osprey’s registration statement on Form S-1, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies to Osprey’s shareholders in connection with the proposed business combination is set forth in the proxy statement/prospectus on Form S-4 for the proposed business combination, which was filed by Osprey on May 13, 2021 as amended on August 2, 2021 with the SEC and the final proxy statement filed on August 11, 2021 with the SEC. Investors and security holders of Osprey and BlackSky are urged to read the proxy statement/prospectus and other relevant documents that will be filed with the SEC carefully and in their entirety when they become available because they will contain important information about the proposed business combination. Investors and security holders will be able to obtain free copies of the proxy statement and other documents containing important information about Osprey and BlackSky through the website maintained by the SEC at www.sec.gov. Copies of the documents filed with the SEC by Osprey can be obtained free of charge by directing a written request to Osprey Technology Acquisition Corp. 1845 Walnut Street, Suite 1111, Philadelphia, PA 19103. Right This presentation is not a substitute for the registration statement or for any other document that Osprey may file with the SEC in connection with the Potential Business Combination. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE OFFERING OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE. Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 3

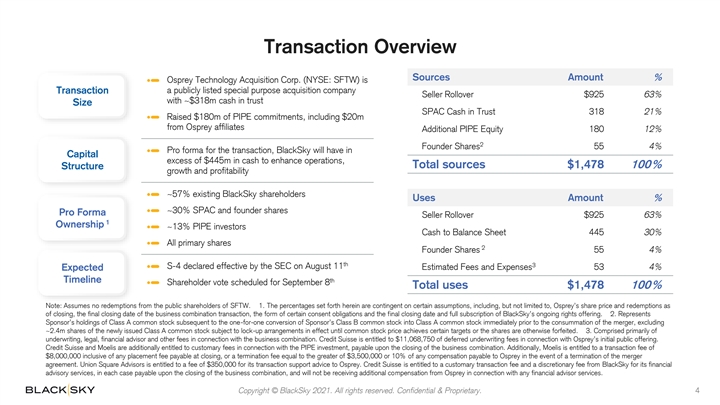

Transaction Overview Sources Amount % Osprey Technology Acquisition Corp. (NYSE: SFTW) is a publicly listed special purpose acquisition company Transaction Seller Rollover $925 63% Transaction with ~$318m cash in trust Size Size SPAC Cash in Trust 318 21% Raised $180m of PIPE commitments, including $20m from Osprey affiliates Additional PIPE Equity 180 12% 2 Founder Shares 55 4% Pro forma for the transaction, BlackSky will have in Capital Capital excess of $445m in cash to enhance operations, Total sources $1,478 100% Structure Structure growth and profitability ~57% existing BlackSky shareholders Uses Amount % ~30% SPAC and founder shares Pro Pro ForFor ma ma Seller Rollover $925 63% 1 (1) Owne Owne rshi rshi p p ~13% PIPE investors Cash to Balance Sheet 445 30% All primary shares 2 Founder Shares 55 4% th 3 S-4 declared effective by the SEC on August 11 Estimated Fees and Expenses 53 4% Expected Expected Timeli Tim ne ing th Shareholder vote scheduled for September 8 Total uses $1,478 100% Note: Assumes no redemptions from the public shareholders of SFTW. 1. The percentages set forth herein are contingent on certain assumptions, including, but not limited to, Osprey’s share price and redemptions as of closing, the final closing date of the business combination transaction, the form of certain consent obligations and the final closing date and full subscription of BlackSky’s ongoing rights offering. 2. Represents Sponsor’s holdings of Class A common stock subsequent to the one-for-one conversion of Sponsor’s Class B common stock into Class A common stock immediately prior to the consummation of the merger, excluding ~2.4m shares of the newly issued Class A common stock subject to lock-up arrangements in effect until common stock price achieves certain targets or the shares are otherwise forfeited. 3. Comprised primarily of underwriting, legal, financial advisor and other fees in connection with the business combination. Credit Suisse is entitled to $11,068,750 of deferred underwriting fees in connection with Osprey’s initial public offering. Credit Suisse and Moelis are additionally entitled to customary fees in connection with the PIPE investment, payable upon the closing of the business combination. Additionally, Moelis is entitled to a transaction fee of $8,000,000 inclusive of any placement fee payable at closing, or a termination fee equal to the greater of $3,500,000 or 10% of any compensation payable to Osprey in the event of a termination of the merger agreement. Union Square Advisors is entitled to a fee of $350,000 for its transaction support advice to Osprey. Credit Suisse is entitled to a customary transaction fee and a discretionary fee from BlackSky for its financial advisory services, in each case payable upon the closing of the business combination, and will not be receiving additional compensation from Osprey in connection with any financial advisor services. Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 4Transaction Overview Sources Amount % Osprey Technology Acquisition Corp. (NYSE: SFTW) is a publicly listed special purpose acquisition company Transaction Seller Rollover $925 63% Transaction with ~$318m cash in trust Size Size SPAC Cash in Trust 318 21% Raised $180m of PIPE commitments, including $20m from Osprey affiliates Additional PIPE Equity 180 12% 2 Founder Shares 55 4% Pro forma for the transaction, BlackSky will have in Capital Capital excess of $445m in cash to enhance operations, Total sources $1,478 100% Structure Structure growth and profitability ~57% existing BlackSky shareholders Uses Amount % ~30% SPAC and founder shares Pro Pro ForFor ma ma Seller Rollover $925 63% 1 (1) Owne Owne rshi rshi p p ~13% PIPE investors Cash to Balance Sheet 445 30% All primary shares 2 Founder Shares 55 4% th 3 S-4 declared effective by the SEC on August 11 Estimated Fees and Expenses 53 4% Expected Expected Timeli Tim ne ing th Shareholder vote scheduled for September 8 Total uses $1,478 100% Note: Assumes no redemptions from the public shareholders of SFTW. 1. The percentages set forth herein are contingent on certain assumptions, including, but not limited to, Osprey’s share price and redemptions as of closing, the final closing date of the business combination transaction, the form of certain consent obligations and the final closing date and full subscription of BlackSky’s ongoing rights offering. 2. Represents Sponsor’s holdings of Class A common stock subsequent to the one-for-one conversion of Sponsor’s Class B common stock into Class A common stock immediately prior to the consummation of the merger, excluding ~2.4m shares of the newly issued Class A common stock subject to lock-up arrangements in effect until common stock price achieves certain targets or the shares are otherwise forfeited. 3. Comprised primarily of underwriting, legal, financial advisor and other fees in connection with the business combination. Credit Suisse is entitled to $11,068,750 of deferred underwriting fees in connection with Osprey’s initial public offering. Credit Suisse and Moelis are additionally entitled to customary fees in connection with the PIPE investment, payable upon the closing of the business combination. Additionally, Moelis is entitled to a transaction fee of $8,000,000 inclusive of any placement fee payable at closing, or a termination fee equal to the greater of $3,500,000 or 10% of any compensation payable to Osprey in the event of a termination of the merger agreement. Union Square Advisors is entitled to a fee of $350,000 for its transaction support advice to Osprey. Credit Suisse is entitled to a customary transaction fee and a discretionary fee from BlackSky for its financial advisory services, in each case payable upon the closing of the business combination, and will not be receiving additional compensation from Osprey in connection with any financial advisor services. Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 4

Recent Highlights Since June 2021 Investor Day 2021 and 2022 Growing Government Pipeline Grows to 2.5b $2.5 Billion Revenue Growth Demand for BlackSky 1.7b on Track Results in Major Wins 2021 Revenue on track to nearly Won ~$30m contract for AI analytics Expanded re-seller network with new double from a US government agency agreements with Ursa Space, Bluesky Contract with NRO expanded in August International and Gtt NetCorp 2022 Revenue remains on track to due to strong demand more than double 2021 Added $135m in new commercial Conducted successful pilots with, and opportunities secured investment from, Palantir 25 New Enterprise Accelerating Experienced Customers by Constellation Public Company Year-end Deployment Leadership On track to sign contracts with Set to achieve constellation of 14 Enhanced leadership and governance 1 multiple Fortune 500 customers in Q3 smallsats by year-end with addition of three new executives, and three highly experienced and Strong incoming interest from >30 Launches identified for the next 11 respected board members enterprise customers smallsats 1. Launch schedules subject to weather, Covid-19 restrictions and other unforeseen launch conditions. Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 5Recent Highlights Since June 2021 Investor Day 2021 and 2022 Growing Government Pipeline Grows to 2.5b $2.5 Billion Revenue Growth Demand for BlackSky 1.7b on Track Results in Major Wins 2021 Revenue on track to nearly Won ~$30m contract for AI analytics Expanded re-seller network with new double from a US government agency agreements with Ursa Space, Bluesky Contract with NRO expanded in August International and Gtt NetCorp 2022 Revenue remains on track to due to strong demand more than double 2021 Added $135m in new commercial Conducted successful pilots with, and opportunities secured investment from, Palantir 25 New Enterprise Accelerating Experienced Customers by Constellation Public Company Year-end Deployment Leadership On track to sign contracts with Set to achieve constellation of 14 Enhanced leadership and governance 1 multiple Fortune 500 customers in Q3 smallsats by year-end with addition of three new executives, and three highly experienced and Strong incoming interest from >30 Launches identified for the next 11 respected board members enterprise customers smallsats 1. Launch schedules subject to weather, Covid-19 restrictions and other unforeseen launch conditions. Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 5

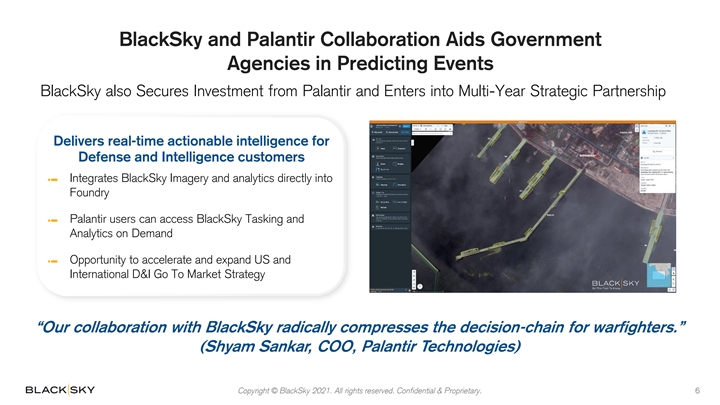

BlackSky and Palantir Collaboration Aids Government Agencies in Predicting Events BlackSky also Secures Investment from Palantir and Enters into Multi-Year Strategic Partnership Delivers real-time actionable intelligence for Defense and Intelligence customers Integrates BlackSky Imagery and analytics directly into Foundry Palantir users can access BlackSky Tasking and Analytics on Demand Opportunity to accelerate and expand US and International D&I Go To Market Strategy “Our collaboration with BlackSky radically compresses the decision-chain for warfighters.” (Shyam Sankar, COO, Palantir Technologies) Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 6 6BlackSky and Palantir Collaboration Aids Government Agencies in Predicting Events BlackSky also Secures Investment from Palantir and Enters into Multi-Year Strategic Partnership Delivers real-time actionable intelligence for Defense and Intelligence customers Integrates BlackSky Imagery and analytics directly into Foundry Palantir users can access BlackSky Tasking and Analytics on Demand Opportunity to accelerate and expand US and International D&I Go To Market Strategy “Our collaboration with BlackSky radically compresses the decision-chain for warfighters.” (Shyam Sankar, COO, Palantir Technologies) Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 6 6

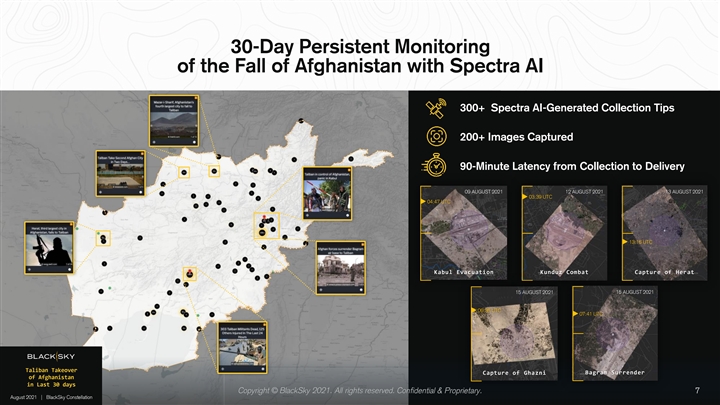

30-Day Persistent Monitoring of the Fall of Afghanistan with Spectra AI 300+ Spectra AI-Generated Collection Tips 200+ Images Captured 90-Minute Latency from Collection to Delivery 09 AUGUST 2021 12 AUGUST 2021 13 AUGUST 2021 03:39 UTC 04:47 UTC 13:16 UTC Kabul Evacuation Kunduz Combat Capture of Herat 15 AUGUST 2021 15 AUGUST 2021 06:36 UTC 07:41 UTC Taliban Takeover Bagram Surrender Capture of Ghazni of Afghanistan in Last 30 days Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 7 7 August 2021 | BlackSky Constellation30-Day Persistent Monitoring of the Fall of Afghanistan with Spectra AI 300+ Spectra AI-Generated Collection Tips 200+ Images Captured 90-Minute Latency from Collection to Delivery 09 AUGUST 2021 12 AUGUST 2021 13 AUGUST 2021 03:39 UTC 04:47 UTC 13:16 UTC Kabul Evacuation Kunduz Combat Capture of Herat 15 AUGUST 2021 15 AUGUST 2021 06:36 UTC 07:41 UTC Taliban Takeover Bagram Surrender Capture of Ghazni of Afghanistan in Last 30 days Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 7 7 August 2021 | BlackSky Constellation

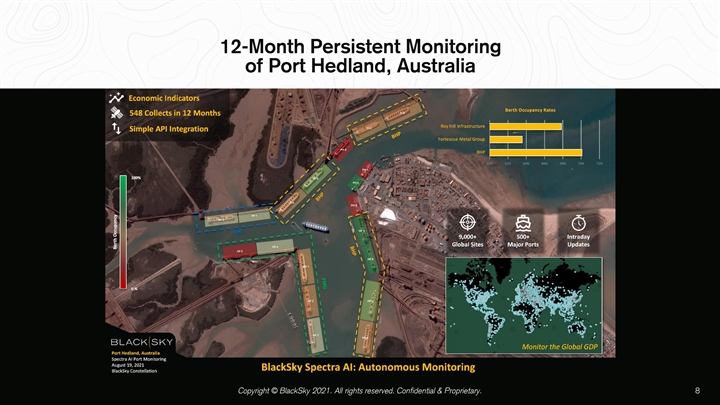

12-Month Persistent Monitoring of Port Hedland, Australia Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 812-Month Persistent Monitoring of Port Hedland, Australia Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 8

BlackSky is Defining the Category of Real-time Global Intelligence Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 9 9BlackSky is Defining the Category of Real-time Global Intelligence Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 9 9

BlackSky is an AI-driven SaaS Platform Powered by our Proprietary Space and Terrestrial Sensor Network We Deliver Real-time Information, Insights and Analytics about our Changing World Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 10

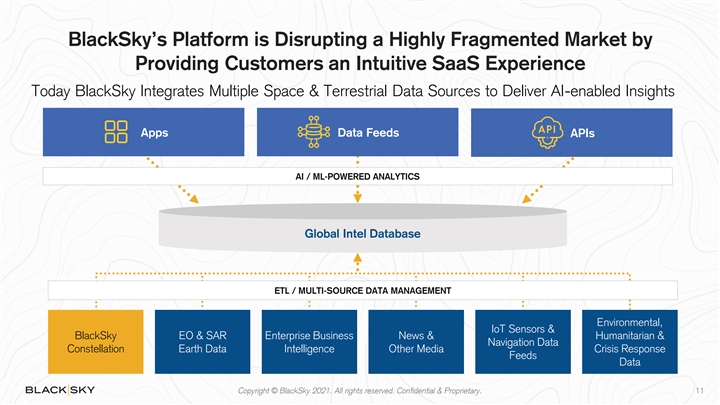

BlackSky’s Platform is Disrupting a Highly Fragmented Market by Providing Customers an Intuitive SaaS Experience Today BlackSky Integrates Multiple Space & Terrestrial Data Sources to Deliver AI-enabled Insights Apps Data Feeds APIs AI / ML-POWERED ANALYTICS Global Intel Database ETL / MULTI-SOURCE DATA MANAGEMENT Environmental, IoT Sensors & BlackSky EO & SAR Enterprise Business News & Humanitarian & Navigation Data Constellation Earth Data Intelligence Other Media Crisis Response Feeds Data Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 11BlackSky’s Platform is Disrupting a Highly Fragmented Market by Providing Customers an Intuitive SaaS Experience Today BlackSky Integrates Multiple Space & Terrestrial Data Sources to Deliver AI-enabled Insights Apps Data Feeds APIs AI / ML-POWERED ANALYTICS Global Intel Database ETL / MULTI-SOURCE DATA MANAGEMENT Environmental, IoT Sensors & BlackSky EO & SAR Enterprise Business News & Humanitarian & Navigation Data Constellation Earth Data Intelligence Other Media Crisis Response Feeds Data Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 11

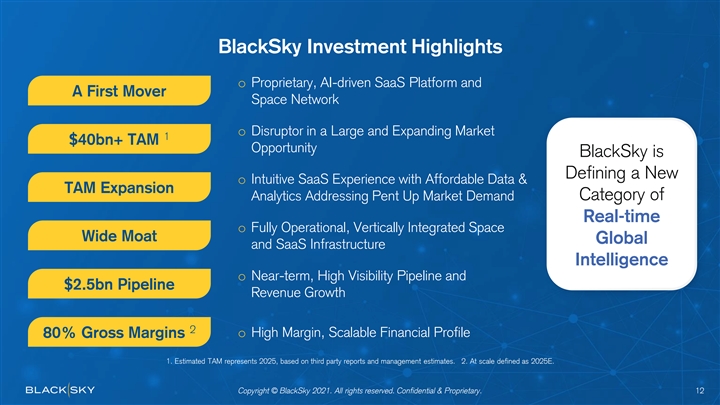

BlackSky Investment Highlights o Proprietary, AI-driven SaaS Platform and A First Mover Space Network o Disruptor in a Large and Expanding Market 1 $40bn+ TAM Opportunity BlackSky is Defining a New o Intuitive SaaS Experience with Affordable Data & TAM Expansion Category of Analytics Addressing Pent Up Market Demand Real-time o Fully Operational, Vertically Integrated Space Wide Moat Global and SaaS Infrastructure Intelligence o Near-term, High Visibility Pipeline and $2.5bn Pipeline Revenue Growth 2 o High Margin, Scalable Financial Profile 80% Gross Margins 1. Estimated TAM represents 2025, based on third party reports and management estimates. 2. At scale defined as 2025E. Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 12BlackSky Investment Highlights o Proprietary, AI-driven SaaS Platform and A First Mover Space Network o Disruptor in a Large and Expanding Market 1 $40bn+ TAM Opportunity BlackSky is Defining a New o Intuitive SaaS Experience with Affordable Data & TAM Expansion Category of Analytics Addressing Pent Up Market Demand Real-time o Fully Operational, Vertically Integrated Space Wide Moat Global and SaaS Infrastructure Intelligence o Near-term, High Visibility Pipeline and $2.5bn Pipeline Revenue Growth 2 o High Margin, Scalable Financial Profile 80% Gross Margins 1. Estimated TAM represents 2025, based on third party reports and management estimates. 2. At scale defined as 2025E. Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 12

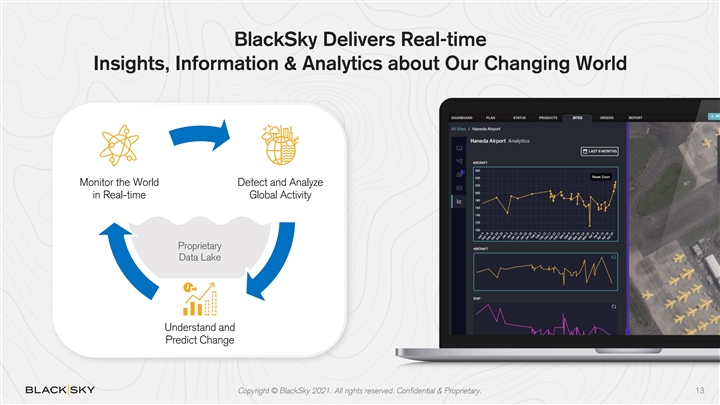

BlackSky Delivers Real-time Insights, Information & Analytics about Our Changing World Monitor the World Detect and Analyze in Real-time Global Activity Proprietary Data Lake Understand and Predict Change Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 13BlackSky Delivers Real-time Insights, Information & Analytics about Our Changing World Monitor the World Detect and Analyze in Real-time Global Activity Proprietary Data Lake Understand and Predict Change Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 13

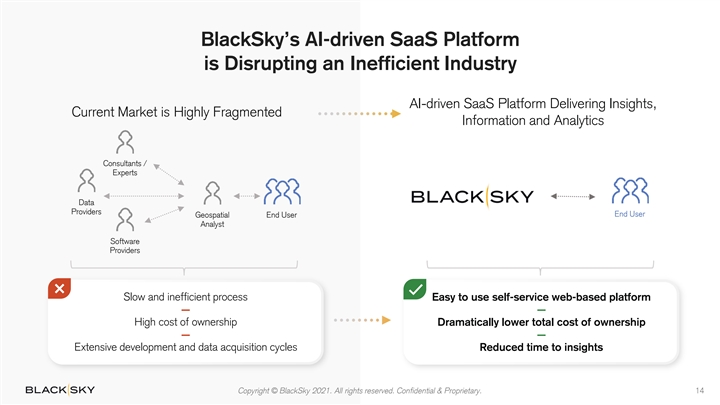

BlackSky’s AI-driven SaaS Platform is Disrupting an Inefficient Industry AI-driven SaaS Platform Delivering Insights, Current Market is Highly Fragmented Information and Analytics Consultants / Experts Data Providers End User Geospatial End User Analyst Software Providers Slow and inefficient process Easy to use self-service web-based platform — — High cost of ownership Dramatically lower total cost of ownership — — Extensive development and data acquisition cycles Reduced time to insights Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 14BlackSky’s AI-driven SaaS Platform is Disrupting an Inefficient Industry AI-driven SaaS Platform Delivering Insights, Current Market is Highly Fragmented Information and Analytics Consultants / Experts Data Providers End User Geospatial End User Analyst Software Providers Slow and inefficient process Easy to use self-service web-based platform — — High cost of ownership Dramatically lower total cost of ownership — — Extensive development and data acquisition cycles Reduced time to insights Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 14

AI-Powered SaaS Platform BlackSky is monitoring Global Activity in Real-time Observations 1M per day from our proprietary data lake of Data >100K Sources delivering Significant ~18K Events per day Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 15AI-Powered SaaS Platform BlackSky is monitoring Global Activity in Real-time Observations 1M per day from our proprietary data lake of Data >100K Sources delivering Significant ~18K Events per day Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 15

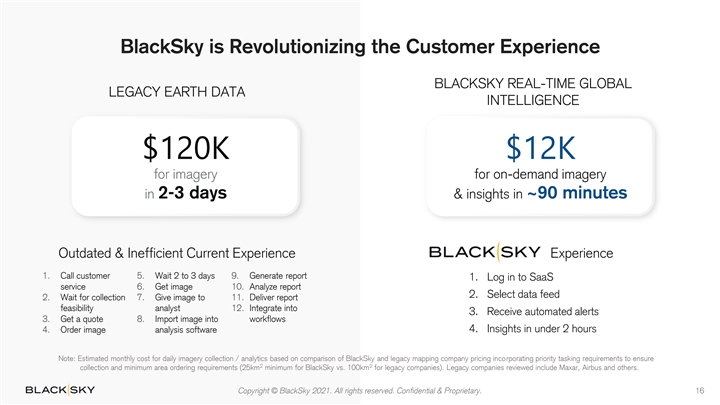

BlackSky is Revolutionizing the Customer Experience BLACKSKY REAL-TIME GLOBAL LEGACY EARTH DATA INTELLIGENCE $120K $12K for imagery for on-demand imagery in 2-3 days & insights in ~90 minutes Outdated & Inefficient Current Experience Experience 1. Call customer 5. Wait 2 to 3 days 9. Generate report 1. Log in to SaaS service 6. Get image 10. Analyze report 2. Select data feed 2. Wait for collection 7. Give image to 11. Deliver report feasibility analyst 12. Integrate into 3. Receive automated alerts 3. Get a quote 8. Import image into workflows 4. Insights in under 2 hours 4. Order image analysis software Note: Estimated monthly cost for daily imagery collection / analytics based on comparison of BlackSky and legacy mapping company pricing incorporating priority tasking requirements to ensure 2 2 collection and minimum area ordering requirements (25km minimum for BlackSky vs. 100km for legacy companies). Legacy companies reviewed include Maxar, Airbus and others. Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 16

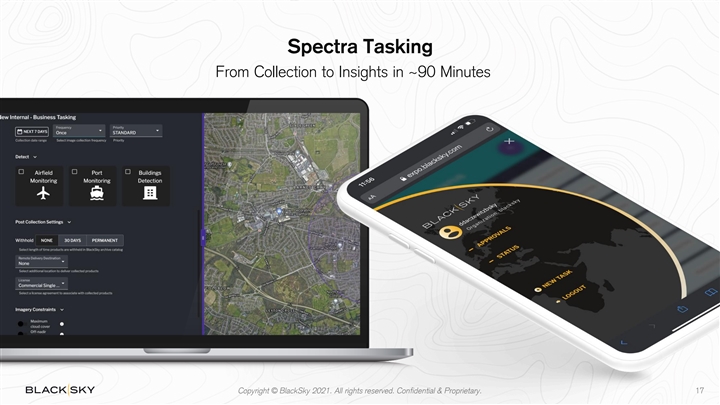

Spectra Tasking From Collection to Insights in ~90 Minutes Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 17Spectra Tasking From Collection to Insights in ~90 Minutes Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 17

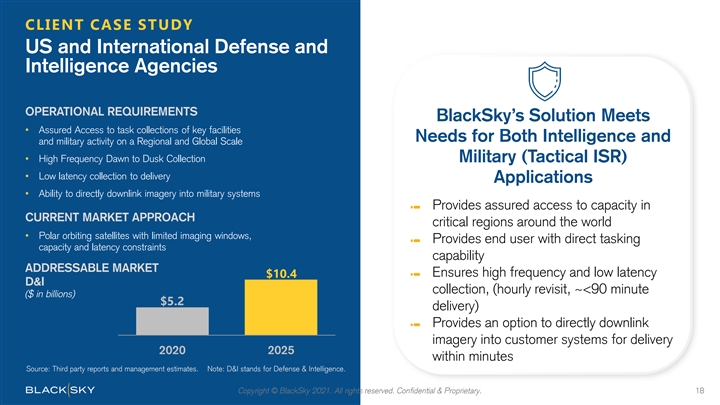

CLIENT CASE STUDY US and International Defense and Intelligence Agencies OPERATIONAL REQUIREMENTS BlackSky’s Solution Meets • Assured Access to task collections of key facilities Needs for Both Intelligence and and military activity on a Regional and Global Scale • High Frequency Dawn to Dusk Collection Military (Tactical ISR) • Low latency collection to delivery Applications • Ability to directly downlink imagery into military systems Provides assured access to capacity in CURRENT MARKET APPROACH critical regions around the world • Polar orbiting satellites with limited imaging windows, Provides end user with direct tasking capacity and latency constraints capability ADDRESSABLE MARKET Ensures high frequency and low latency $10.4 D&I collection, (hourly revisit, ~<90 minute ($ in billions) $5.2 delivery) Provides an option to directly downlink imagery into customer systems for delivery 2020 2025 within minutes Source: Third party reports and management estimates. Note: D&I stands for Defense & Intelligence. Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 18CLIENT CASE STUDY US and International Defense and Intelligence Agencies OPERATIONAL REQUIREMENTS BlackSky’s Solution Meets • Assured Access to task collections of key facilities Needs for Both Intelligence and and military activity on a Regional and Global Scale • High Frequency Dawn to Dusk Collection Military (Tactical ISR) • Low latency collection to delivery Applications • Ability to directly downlink imagery into military systems Provides assured access to capacity in CURRENT MARKET APPROACH critical regions around the world • Polar orbiting satellites with limited imaging windows, Provides end user with direct tasking capacity and latency constraints capability ADDRESSABLE MARKET Ensures high frequency and low latency $10.4 D&I collection, (hourly revisit, ~<90 minute ($ in billions) $5.2 delivery) Provides an option to directly downlink imagery into customer systems for delivery 2020 2025 within minutes Source: Third party reports and management estimates. Note: D&I stands for Defense & Intelligence. Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 18

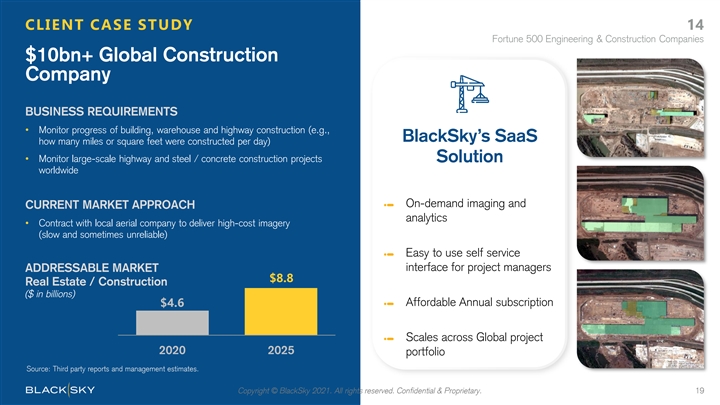

CLIENT CASE STUDY 14 Fortune 500 Engineering & Construction Companies $10bn+ Global Construction Company BUSINESS REQUIREMENTS • Monitor progress of building, warehouse and highway construction (e.g., BlackSky’s SaaS how many miles or square feet were constructed per day) • Monitor large-scale highway and steel / concrete construction projects Solution worldwide On-demand imaging and CURRENT MARKET APPROACH analytics • Contract with local aerial company to deliver high-cost imagery (slow and sometimes unreliable) Easy to use self service interface for project managers ADDRESSABLE MARKET $8.8 Real Estate / Construction ($ in billions) Affordable Annual subscription $4.6 Scales across Global project 2020 2025 portfolio Source: Third party reports and management estimates. Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 19CLIENT CASE STUDY 14 Fortune 500 Engineering & Construction Companies $10bn+ Global Construction Company BUSINESS REQUIREMENTS • Monitor progress of building, warehouse and highway construction (e.g., BlackSky’s SaaS how many miles or square feet were constructed per day) • Monitor large-scale highway and steel / concrete construction projects Solution worldwide On-demand imaging and CURRENT MARKET APPROACH analytics • Contract with local aerial company to deliver high-cost imagery (slow and sometimes unreliable) Easy to use self service interface for project managers ADDRESSABLE MARKET $8.8 Real Estate / Construction ($ in billions) Affordable Annual subscription $4.6 Scales across Global project 2020 2025 portfolio Source: Third party reports and management estimates. Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 19

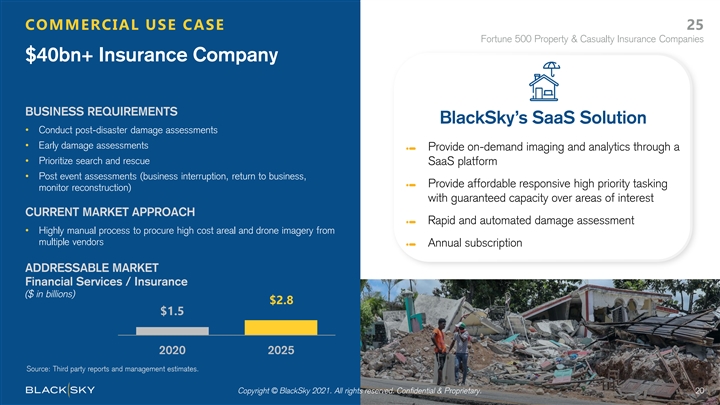

COMMERCIAL USE CASE 25 Fortune 500 Property & Casualty Insurance Companies $40bn+ Insurance Company BUSINESS REQUIREMENTS BlackSky’s SaaS Solution • Conduct post-disaster damage assessments • Early damage assessments Provide on-demand imaging and analytics through a • Prioritize search and rescue SaaS platform • Post event assessments (business interruption, return to business, Provide affordable responsive high priority tasking monitor reconstruction) with guaranteed capacity over areas of interest CURRENT MARKET APPROACH Rapid and automated damage assessment • Highly manual process to procure high cost areal and drone imagery from multiple vendors Annual subscription ADDRESSABLE MARKET Financial Services / Insurance ($ in billions) $2.8 $1.5 2020 2025 Source: Third party reports and management estimates. Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 20

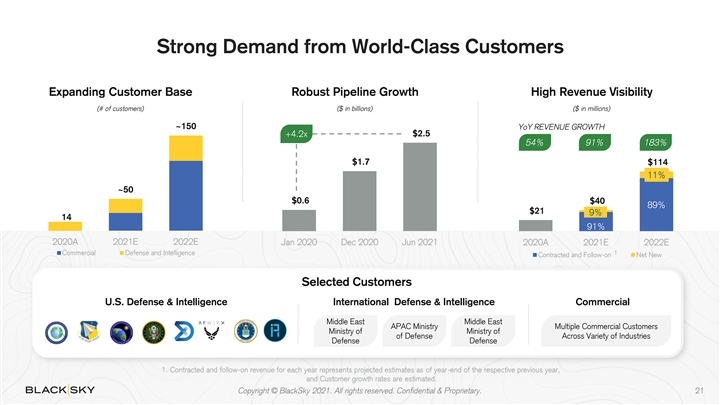

Strong Demand from World-Class Customers Expanding Customer Base Robust Pipeline Growth High Revenue Visibility (# of customers) ($ in billions) ($ in millions) ~150 YoY REVENUE GROWTH $2.5 +4.2x 54% 91% 183% $1.7 $114 11% ~50 $0.6 $40 89% $21 9% 14 91% 2020A 2021E 2022E Jan 2020 Dec 2020 Jun 2021 2020A 2021E 2022E Commercial Defense and Intelligence 1 Contracted and Follow-on Net New Selected Customers U.S. Defense & Intelligence International Defense & Intelligence Commercial Middle East Middle East APAC Ministry Multiple Commercial Customers Ministry of Ministry of of Defense Across Variety of Industries Defense Defense 1. Contracted and follow-on revenue for each year represents projected estimates as of year-end of the respective previous year, and Customer growth rates are estimated. Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 21Strong Demand from World-Class Customers Expanding Customer Base Robust Pipeline Growth High Revenue Visibility (# of customers) ($ in billions) ($ in millions) ~150 YoY REVENUE GROWTH $2.5 +4.2x 54% 91% 183% $1.7 $114 11% ~50 $0.6 $40 89% $21 9% 14 91% 2020A 2021E 2022E Jan 2020 Dec 2020 Jun 2021 2020A 2021E 2022E Commercial Defense and Intelligence 1 Contracted and Follow-on Net New Selected Customers U.S. Defense & Intelligence International Defense & Intelligence Commercial Middle East Middle East APAC Ministry Multiple Commercial Customers Ministry of Ministry of of Defense Across Variety of Industries Defense Defense 1. Contracted and follow-on revenue for each year represents projected estimates as of year-end of the respective previous year, and Customer growth rates are estimated. Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 21

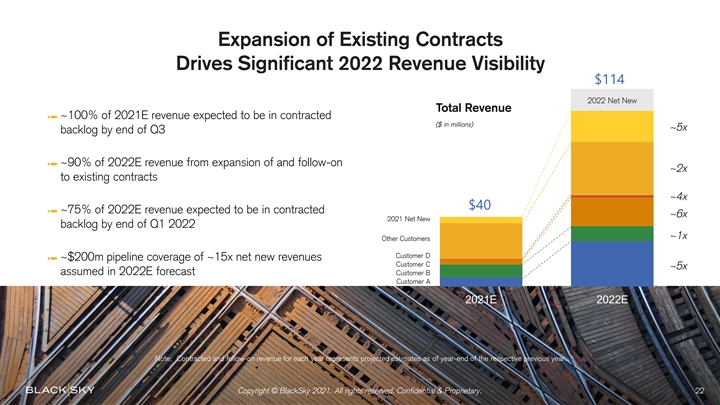

Expansion of Existing Contracts Drives Significant 2022 Revenue Visibility $114 $114 2022 Net New Total Revenue ~100% of 2021E revenue expected to be in contracted ($ in millions) ~5x backlog by end of Q3 ~90% of 2022E revenue from expansion of and follow-on ~2x to existing contracts ~4x $40 $40 ~75% of 2022E revenue expected to be in contracted ~6x 2021 Net New backlog by end of Q1 2022 ~1x Other Customers Customer D ~$200m pipeline coverage of ~15x net new revenues Customer C ~5x assumed in 2022E forecast Customer B Customer A 2021E 2022E Note: Contracted and follow-on revenue for each year represents projected estimates as of year-end of the respective previous year. Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 22Expansion of Existing Contracts Drives Significant 2022 Revenue Visibility $114 $114 2022 Net New Total Revenue ~100% of 2021E revenue expected to be in contracted ($ in millions) ~5x backlog by end of Q3 ~90% of 2022E revenue from expansion of and follow-on ~2x to existing contracts ~4x $40 $40 ~75% of 2022E revenue expected to be in contracted ~6x 2021 Net New backlog by end of Q1 2022 ~1x Other Customers Customer D ~$200m pipeline coverage of ~15x net new revenues Customer C ~5x assumed in 2022E forecast Customer B Customer A 2021E 2022E Note: Contracted and follow-on revenue for each year represents projected estimates as of year-end of the respective previous year. Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 22

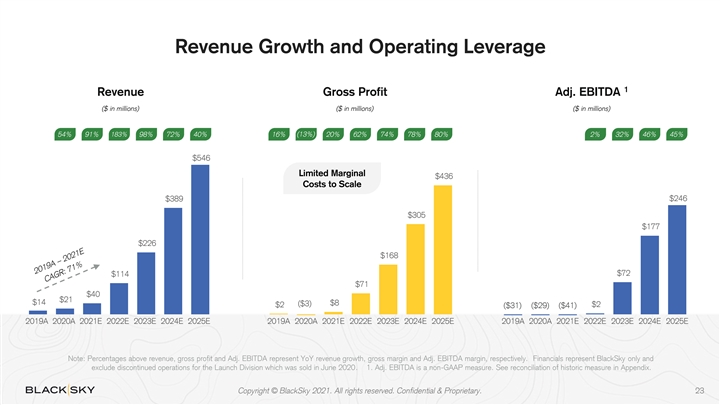

Revenue Growth and Operating Leverage 1 Revenue Gross Profit Adj. EBITDA ($ in millions) ($ in millions) ($ in millions) 54% 91% 183% 98% 72% 40% 16% (13%) 20% 62% 74% 78% 80% 2% 32% 46% 45% $546 Limited Marginal $436 Costs to Scale $246 $389 $305 $177 $226 $168 $72 $114 $71 $40 $21 $14 ($3) $8 $2 $2 ($31) ($29) ($41) 2019A 2020A 2021E 2022E 2023E 2024E 2025E 2019A 2020A 2021E 2022E 2023E 2024E 2025E 2019A 2020A 2021E 2022E 2023E 2024E 2025E Note: Percentages above revenue, gross profit and Adj. EBITDA represent YoY revenue growth, gross margin and Adj. EBITDA margin, respectively. Financials represent BlackSky only and exclude discontinued operations for the Launch Division which was sold in June 2020. 1. Adj. EBITDA is a non-GAAP measure. See reconciliation of historic measure in Appendix. Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 23Revenue Growth and Operating Leverage 1 Revenue Gross Profit Adj. EBITDA ($ in millions) ($ in millions) ($ in millions) 54% 91% 183% 98% 72% 40% 16% (13%) 20% 62% 74% 78% 80% 2% 32% 46% 45% $546 Limited Marginal $436 Costs to Scale $246 $389 $305 $177 $226 $168 $72 $114 $71 $40 $21 $14 ($3) $8 $2 $2 ($31) ($29) ($41) 2019A 2020A 2021E 2022E 2023E 2024E 2025E 2019A 2020A 2021E 2022E 2023E 2024E 2025E 2019A 2020A 2021E 2022E 2023E 2024E 2025E Note: Percentages above revenue, gross profit and Adj. EBITDA represent YoY revenue growth, gross margin and Adj. EBITDA margin, respectively. Financials represent BlackSky only and exclude discontinued operations for the Launch Division which was sold in June 2020. 1. Adj. EBITDA is a non-GAAP measure. See reconciliation of historic measure in Appendix. Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 23

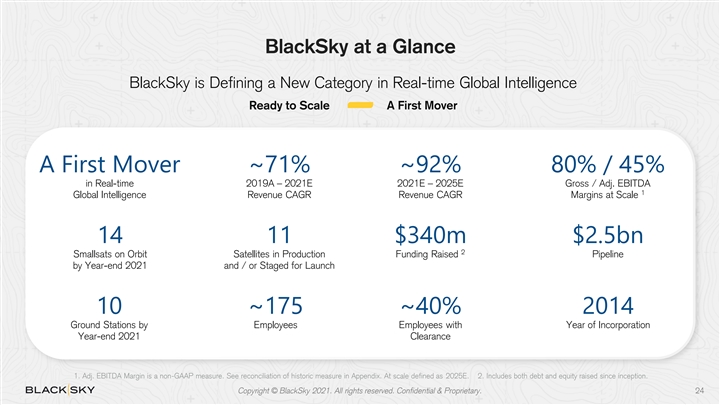

BlackSky at a Glance BlackSky is Defining a New Category in Real-time Global Intelligence Ready to Scale A First Mover A First Mover ~71% ~92% 80% / 45% in Real-time 2019A – 2021E 2021E – 2025E Gross / Adj. EBITDA 1 Global Intelligence Revenue CAGR Revenue CAGR Margins at Scale 14 11 $340m $2.5bn 2 Smallsats on Orbit Satellites in Production Funding Raised Pipeline by Year-end 2021 and / or Staged for Launch 10 ~175 ~40% 2014 Ground Stations by Employees Employees with Year of Incorporation Year-end 2021 Clearance 1. Adj. EBITDA Margin is a non-GAAP measure. See reconciliation of historic measure in Appendix. At scale defined as 2025E. 2. Includes both debt and equity raised since inception. Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 24BlackSky at a Glance BlackSky is Defining a New Category in Real-time Global Intelligence Ready to Scale A First Mover A First Mover ~71% ~92% 80% / 45% in Real-time 2019A – 2021E 2021E – 2025E Gross / Adj. EBITDA 1 Global Intelligence Revenue CAGR Revenue CAGR Margins at Scale 14 11 $340m $2.5bn 2 Smallsats on Orbit Satellites in Production Funding Raised Pipeline by Year-end 2021 and / or Staged for Launch 10 ~175 ~40% 2014 Ground Stations by Employees Employees with Year of Incorporation Year-end 2021 Clearance 1. Adj. EBITDA Margin is a non-GAAP measure. See reconciliation of historic measure in Appendix. At scale defined as 2025E. 2. Includes both debt and equity raised since inception. Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 24

MARKET OPPORTUNITY & COMPETITIVE LANDSCAPE 25MARKET OPPORTUNITY & COMPETITIVE LANDSCAPE 25

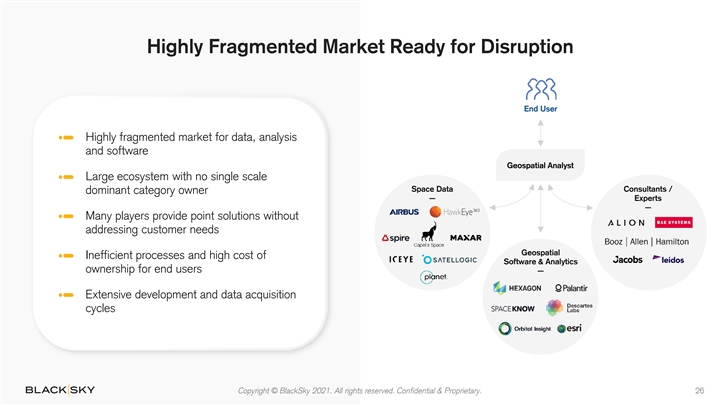

Highly Fragmented Market Ready for Disruption End User Highly fragmented market for data, analysis and software Geospatial Analyst Large ecosystem with no single scale Space Data Consultants / dominant category owner — Experts — Many players provide point solutions without addressing customer needs Geospatial Inefficient processes and high cost of Software & Analytics ownership for end users — Extensive development and data acquisition cycles Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 26

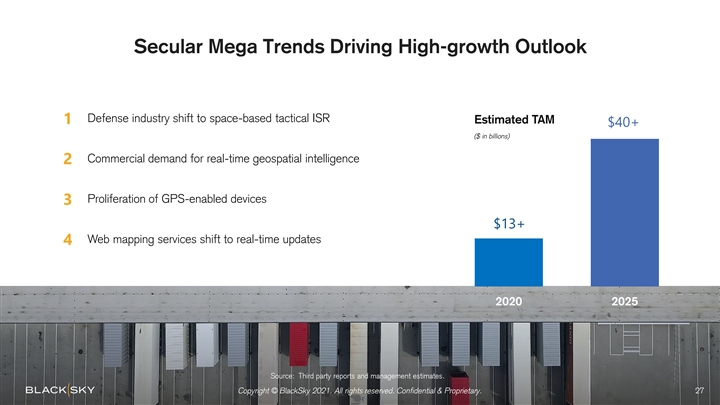

Secular Mega Trends Driving High-growth Outlook Defense industry shift to space-based tactical ISR 1 Estimated TAM $40+ ($ in billions) Commercial demand for real-time geospatial intelligence 2 Proliferation of GPS-enabled devices 3 $13+ Web mapping services shift to real-time updates 4 2020 2025 Source: Third party reports and management estimates. Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 27Secular Mega Trends Driving High-growth Outlook Defense industry shift to space-based tactical ISR 1 Estimated TAM $40+ ($ in billions) Commercial demand for real-time geospatial intelligence 2 Proliferation of GPS-enabled devices 3 $13+ Web mapping services shift to real-time updates 4 2020 2025 Source: Third party reports and management estimates. Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 27

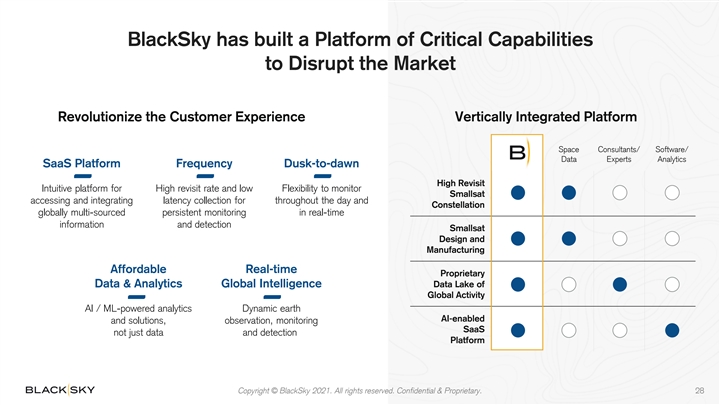

BlackSky has built a Platform of Critical Capabilities to Disrupt the Market Revolutionize the Customer Experience Vertically Integrated Platform Space Consultants/ Software/ Data Experts Analytics SaaS Platform Frequency Dusk-to-dawn High Revisit Intuitive platform for High revisit rate and low Flexibility to monitor Smallsat accessing and integrating latency collection for throughout the day and Constellation globally multi-sourced persistent monitoring in real-time information and detection Smallsat Design and Manufacturing Affordable Real-time Proprietary Data Lake of Data & Analytics Global Intelligence Global Activity AI / ML-powered analytics Dynamic earth AI-enabled and solutions, observation, monitoring SaaS not just data and detection Platform Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 28BlackSky has built a Platform of Critical Capabilities to Disrupt the Market Revolutionize the Customer Experience Vertically Integrated Platform Space Consultants/ Software/ Data Experts Analytics SaaS Platform Frequency Dusk-to-dawn High Revisit Intuitive platform for High revisit rate and low Flexibility to monitor Smallsat accessing and integrating latency collection for throughout the day and Constellation globally multi-sourced persistent monitoring in real-time information and detection Smallsat Design and Manufacturing Affordable Real-time Proprietary Data Lake of Data & Analytics Global Intelligence Global Activity AI / ML-powered analytics Dynamic earth AI-enabled and solutions, observation, monitoring SaaS not just data and detection Platform Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 28

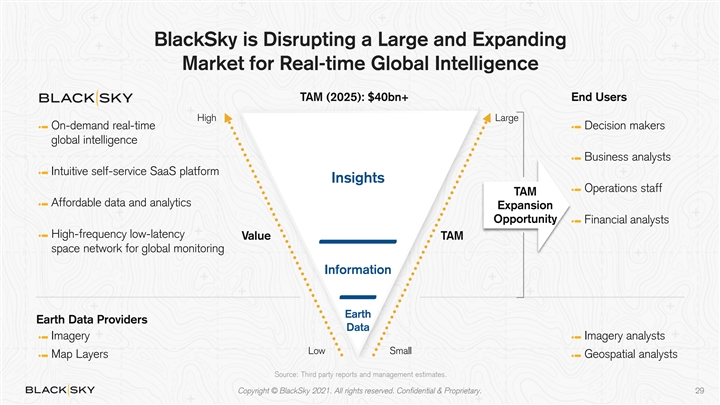

BlackSky is Disrupting a Large and Expanding Market for Real-time Global Intelligence TAM (2025): $40bn+ End Users High Large On-demand real-time Decision makers global intelligence Business analysts Intuitive self-service SaaS platform Insights Operations staff TAM Affordable data and analytics Expansion Opportunity Financial analysts High-frequency low-latency Value TAM space network for global monitoring Information Earth Earth Data Providers Data Imagery Imagery analysts Low Small Map Layers Geospatial analysts Source: Third party reports and management estimates. Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 29BlackSky is Disrupting a Large and Expanding Market for Real-time Global Intelligence TAM (2025): $40bn+ End Users High Large On-demand real-time Decision makers global intelligence Business analysts Intuitive self-service SaaS platform Insights Operations staff TAM Affordable data and analytics Expansion Opportunity Financial analysts High-frequency low-latency Value TAM space network for global monitoring Information Earth Earth Data Providers Data Imagery Imagery analysts Low Small Map Layers Geospatial analysts Source: Third party reports and management estimates. Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 29

Enabling a Revolutionary Customer Experience Increases speed Reduces high Lowers total Integrated directly Easy to insights start-up, data, cost of into customer to Use software and ownership workflows staffing costs Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 30Enabling a Revolutionary Customer Experience Increases speed Reduces high Lowers total Integrated directly Easy to insights start-up, data, cost of into customer to Use software and ownership workflows staffing costs Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 30

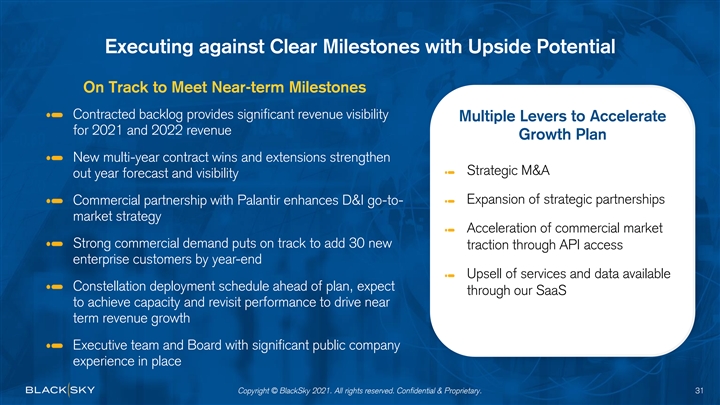

Executing against Clear Milestones with Upside Potential On Track to Meet Near-term Milestones Contracted backlog provides significant revenue visibility Multiple Levers to Accelerate for 2021 and 2022 revenue Growth Plan New multi-year contract wins and extensions strengthen Strategic M&A out year forecast and visibility Expansion of strategic partnerships Commercial partnership with Palantir enhances D&I go-to- market strategy Acceleration of commercial market Strong commercial demand puts on track to add 30 new traction through API access enterprise customers by year-end Upsell of services and data available Constellation deployment schedule ahead of plan, expect through our SaaS to achieve capacity and revisit performance to drive near term revenue growth Executive team and Board with significant public company experience in place Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 31

APPENDIX 32APPENDIX 32

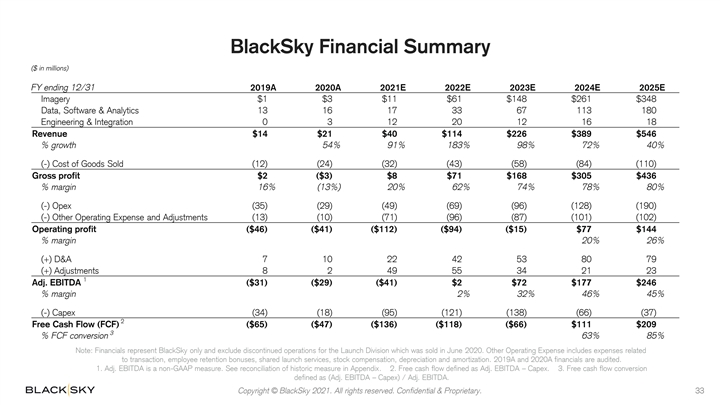

BlackSky Financial Summary ($ in millions) FY ending 12/31 2019A 2020A 2021E 2022E 2023E 2024E 2025E Imagery $1 $3 $11 $61 $148 $261 $348 Data, Software & Analytics 13 16 17 33 67 113 180 Engineering & Integration 0 3 12 20 12 16 18 Revenue $14 $21 $40 $114 $226 $389 $546 % growth 54% 91% 183% 98% 72% 40% (-) Cost of Goods Sold (12) (24) (32) (43) (58) (84) (110) Gross profit $2 ($3) $8 $71 $168 $305 $436 % margin 16% (13%) 20% 62% 74% 78% 80% (-) Opex (35) (29) (49) (69) (96) (128) (190) (-) Other Operating Expense and Adjustments (13) (10) (71) (96) (87) (101) (102) Operating profit ($46) ($41) ($112) ($94) ($15) $77 $144 % margin 20% 26% (+) D&A 7 10 22 42 53 80 79 (+) Adjustments 8 2 49 55 34 21 23 1 Adj. EBITDA ($31) ($29) ($41) $2 $72 $177 $246 % margin 2% 32% 46% 45% (-) Capex (34) (18) (95) (121) (138) (66) (37) 2 Free Cash Flow (FCF) ($65) ($47) ($136) ($118) ($66) $111 $209 3 % FCF conversion 63% 85% Note: Financials represent BlackSky only and exclude discontinued operations for the Launch Division which was sold in June 2020. Other Operating Expense includes expenses related to transaction, employee retention bonuses, shared launch services, stock compensation, depreciation and amortization. 2019A and 2020A financials are audited. 1. Adj. EBITDA is a non-GAAP measure. See reconciliation of historic measure in Appendix. 2. Free cash flow defined as Adj. EBITDA – Capex. 3. Free cash flow conversion defined as (Adj. EBITDA – Capex) / Adj. EBITDA. Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 33BlackSky Financial Summary ($ in millions) FY ending 12/31 2019A 2020A 2021E 2022E 2023E 2024E 2025E Imagery $1 $3 $11 $61 $148 $261 $348 Data, Software & Analytics 13 16 17 33 67 113 180 Engineering & Integration 0 3 12 20 12 16 18 Revenue $14 $21 $40 $114 $226 $389 $546 % growth 54% 91% 183% 98% 72% 40% (-) Cost of Goods Sold (12) (24) (32) (43) (58) (84) (110) Gross profit $2 ($3) $8 $71 $168 $305 $436 % margin 16% (13%) 20% 62% 74% 78% 80% (-) Opex (35) (29) (49) (69) (96) (128) (190) (-) Other Operating Expense and Adjustments (13) (10) (71) (96) (87) (101) (102) Operating profit ($46) ($41) ($112) ($94) ($15) $77 $144 % margin 20% 26% (+) D&A 7 10 22 42 53 80 79 (+) Adjustments 8 2 49 55 34 21 23 1 Adj. EBITDA ($31) ($29) ($41) $2 $72 $177 $246 % margin 2% 32% 46% 45% (-) Capex (34) (18) (95) (121) (138) (66) (37) 2 Free Cash Flow (FCF) ($65) ($47) ($136) ($118) ($66) $111 $209 3 % FCF conversion 63% 85% Note: Financials represent BlackSky only and exclude discontinued operations for the Launch Division which was sold in June 2020. Other Operating Expense includes expenses related to transaction, employee retention bonuses, shared launch services, stock compensation, depreciation and amortization. 2019A and 2020A financials are audited. 1. Adj. EBITDA is a non-GAAP measure. See reconciliation of historic measure in Appendix. 2. Free cash flow defined as Adj. EBITDA – Capex. 3. Free cash flow conversion defined as (Adj. EBITDA – Capex) / Adj. EBITDA. Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 33

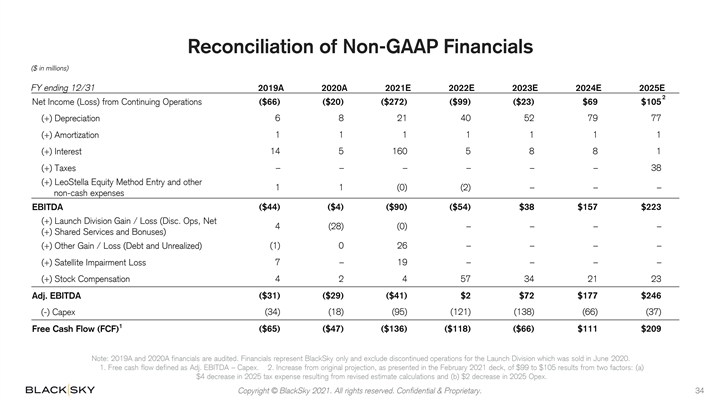

Reconciliation of Non-GAAP Financials ($ in millions) FY ending 12/31 2019A 2020A 2021E 2022E 2023E 2024E 2025E 2 Net Income (Loss) from Continuing Operations ($66) ($20) ($272) ($99) ($23) $69 $105 (+) Depreciation 6 8 21 40 52 79 77 (+) Amortization 1 1 1 1 1 1 1 (+) Interest 14 5 160 5 8 8 1 (+) Taxes – – – – – – 38 (+) LeoStella Equity Method Entry and other 1 1 (0) (2) – – – non-cash expenses EBITDA ($44) ($4) ($90) ($54) $38 $157 $223 (+) Launch Division Gain / Loss (Disc. Ops, Net 4 (28) (0) – – – – (+) Shared Services and Bonuses) (+) Other Gain / Loss (Debt and Unrealized) (1) 0 26 – – – – (+) Satellite Impairment Loss 7 – 19 – – – – (+) Stock Compensation 4 2 4 57 34 21 23 Adj. EBITDA ($31) ($29) ($41) $2 $72 $177 $246 (-) Capex (34) (18) (95) (121) (138) (66) (37) 1 Free Cash Flow (FCF) ($65) ($47) ($136) ($118) ($66) $111 $209 Note: 2019A and 2020A financials are audited. Financials represent BlackSky only and exclude discontinued operations for the Launch Division which was sold in June 2020. 1. Free cash flow defined as Adj. EBITDA – Capex. 2. Increase from original projection, as presented in the February 2021 deck, of $99 to $105 results from two factors: (a) $4 decrease in 2025 tax expense resulting from revised estimate calculations and (b) $2 decrease in 2025 Opex. Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 34Reconciliation of Non-GAAP Financials ($ in millions) FY ending 12/31 2019A 2020A 2021E 2022E 2023E 2024E 2025E 2 Net Income (Loss) from Continuing Operations ($66) ($20) ($272) ($99) ($23) $69 $105 (+) Depreciation 6 8 21 40 52 79 77 (+) Amortization 1 1 1 1 1 1 1 (+) Interest 14 5 160 5 8 8 1 (+) Taxes – – – – – – 38 (+) LeoStella Equity Method Entry and other 1 1 (0) (2) – – – non-cash expenses EBITDA ($44) ($4) ($90) ($54) $38 $157 $223 (+) Launch Division Gain / Loss (Disc. Ops, Net 4 (28) (0) – – – – (+) Shared Services and Bonuses) (+) Other Gain / Loss (Debt and Unrealized) (1) 0 26 – – – – (+) Satellite Impairment Loss 7 – 19 – – – – (+) Stock Compensation 4 2 4 57 34 21 23 Adj. EBITDA ($31) ($29) ($41) $2 $72 $177 $246 (-) Capex (34) (18) (95) (121) (138) (66) (37) 1 Free Cash Flow (FCF) ($65) ($47) ($136) ($118) ($66) $111 $209 Note: 2019A and 2020A financials are audited. Financials represent BlackSky only and exclude discontinued operations for the Launch Division which was sold in June 2020. 1. Free cash flow defined as Adj. EBITDA – Capex. 2. Increase from original projection, as presented in the February 2021 deck, of $99 to $105 results from two factors: (a) $4 decrease in 2025 tax expense resulting from revised estimate calculations and (b) $2 decrease in 2025 Opex. Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 34

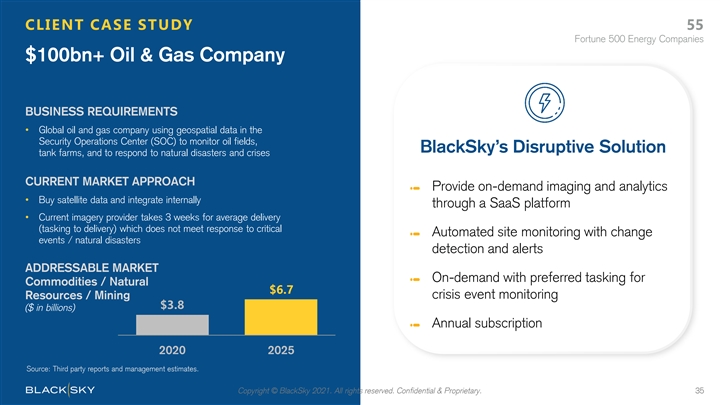

CLIENT CASE STUDY 55 Fortune 500 Energy Companies $100bn+ Oil & Gas Company BUSINESS REQUIREMENTS • Global oil and gas company using geospatial data in the Security Operations Center (SOC) to monitor oil fields, BlackSky’s Disruptive Solution tank farms, and to respond to natural disasters and crises CURRENT MARKET APPROACH Provide on-demand imaging and analytics • Buy satellite data and integrate internally through a SaaS platform • Current imagery provider takes 3 weeks for average delivery (tasking to delivery) which does not meet response to critical Automated site monitoring with change events / natural disasters detection and alerts ADDRESSABLE MARKET On-demand with preferred tasking for Commodities / Natural $6.7 Resources / Mining crisis event monitoring $3.8 ($ in billions) Annual subscription 2020 2025 Source: Third party reports and management estimates. Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 35CLIENT CASE STUDY 55 Fortune 500 Energy Companies $100bn+ Oil & Gas Company BUSINESS REQUIREMENTS • Global oil and gas company using geospatial data in the Security Operations Center (SOC) to monitor oil fields, BlackSky’s Disruptive Solution tank farms, and to respond to natural disasters and crises CURRENT MARKET APPROACH Provide on-demand imaging and analytics • Buy satellite data and integrate internally through a SaaS platform • Current imagery provider takes 3 weeks for average delivery (tasking to delivery) which does not meet response to critical Automated site monitoring with change events / natural disasters detection and alerts ADDRESSABLE MARKET On-demand with preferred tasking for Commodities / Natural $6.7 Resources / Mining crisis event monitoring $3.8 ($ in billions) Annual subscription 2020 2025 Source: Third party reports and management estimates. Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 35

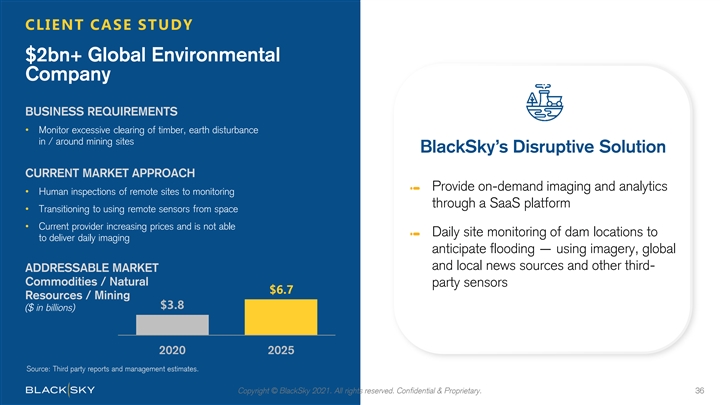

CLIENT CASE STUDY $2bn+ Global Environmental Company BUSINESS REQUIREMENTS • Monitor excessive clearing of timber, earth disturbance in / around mining sites BlackSky’s Disruptive Solution CURRENT MARKET APPROACH Provide on-demand imaging and analytics • Human inspections of remote sites to monitoring through a SaaS platform • Transitioning to using remote sensors from space • Current provider increasing prices and is not able Daily site monitoring of dam locations to to deliver daily imaging anticipate flooding — using imagery, global and local news sources and other third- ADDRESSABLE MARKET Commodities / Natural party sensors $6.7 Resources / Mining $3.8 ($ in billions) 2020 2025 Source: Third party reports and management estimates. Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 36CLIENT CASE STUDY $2bn+ Global Environmental Company BUSINESS REQUIREMENTS • Monitor excessive clearing of timber, earth disturbance in / around mining sites BlackSky’s Disruptive Solution CURRENT MARKET APPROACH Provide on-demand imaging and analytics • Human inspections of remote sites to monitoring through a SaaS platform • Transitioning to using remote sensors from space • Current provider increasing prices and is not able Daily site monitoring of dam locations to to deliver daily imaging anticipate flooding — using imagery, global and local news sources and other third- ADDRESSABLE MARKET Commodities / Natural party sensors $6.7 Resources / Mining $3.8 ($ in billions) 2020 2025 Source: Third party reports and management estimates. Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 36

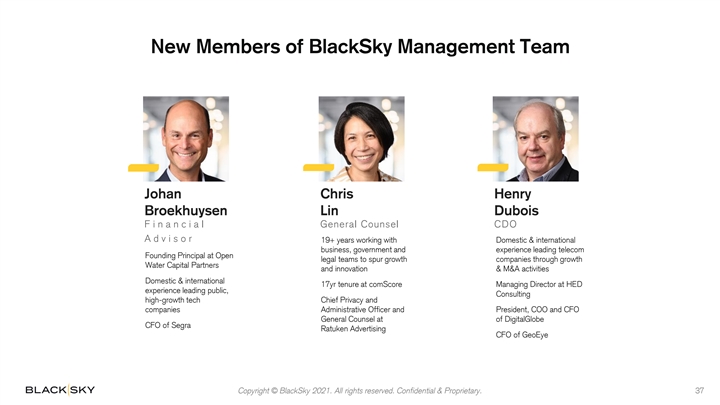

New Members of BlackSky Management Team Johan Chris Henry Broekhuysen Lin Dubois F i n a n c i a l General Counsel CDO A d v i s o r 19+ years working with Domestic & international business, government and experience leading telecom Founding Principal at Open legal teams to spur growth companies through growth Water Capital Partners and innovation & M&A activities Domestic & international 17yr tenure at comScore Managing Director at HED experience leading public, Consulting high-growth tech Chief Privacy and companies Administrative Officer and President, COO and CFO General Counsel at of DigitalGlobe CFO of Segra Ratuken Advertising CFO of GeoEye Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 37New Members of BlackSky Management Team Johan Chris Henry Broekhuysen Lin Dubois F i n a n c i a l General Counsel CDO A d v i s o r 19+ years working with Domestic & international business, government and experience leading telecom Founding Principal at Open legal teams to spur growth companies through growth Water Capital Partners and innovation & M&A activities Domestic & international 17yr tenure at comScore Managing Director at HED experience leading public, Consulting high-growth tech Chief Privacy and companies Administrative Officer and President, COO and CFO General Counsel at of DigitalGlobe CFO of Segra Ratuken Advertising CFO of GeoEye Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 37

New Board Members Dr. Magid M. Tim Harvey James Abraham Tolonen Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 38New Board Members Dr. Magid M. Tim Harvey James Abraham Tolonen Copyright © BlackSky 2021. All rights reserved. Confidential & Proprietary. 38