Filed Pursuant to Rule 424(b)(3)

Registration No. 333-256103

OSPREY TECHNOLOGY ACQUISITION CORP.

1845 Walnut Street, Suite 1111,

Philadelphia, PA 19103

Dear Stockholders of Osprey Technology Acquisition Corp.:

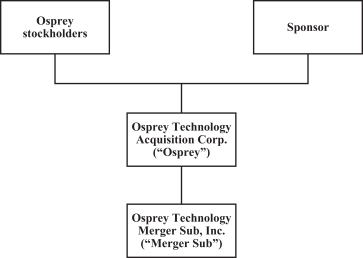

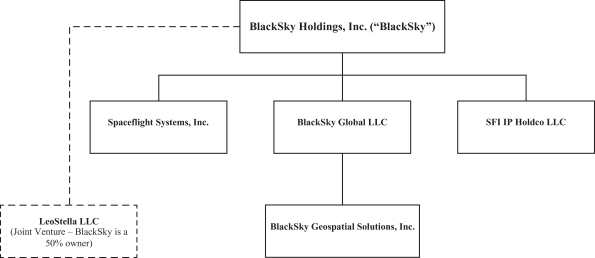

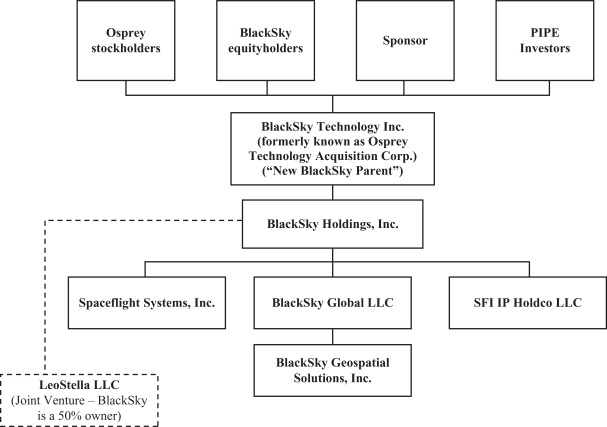

On February 17, 2021, Osprey Technology Acquisition Corp., a Delaware corporation (“Osprey”), and Osprey Technology Merger Sub, Inc., a Delaware corporation and a wholly-owned subsidiary of Osprey (“Merger Sub”), entered into an Agreement and Plan of Merger (as it may be amended and/or restated from time to time, the “merger agreement”) with BlackSky Holdings, Inc., a Delaware corporation (“BlackSky”). A copy of the merger agreement is attached to this proxy statement/consent solicitation statement/prospectus as Annex A; any inconsistencies between this proxy statement/consent solicitation statement/prospectus and the merger agreement shall be determined by reference to the merger agreement. If the merger agreement and the transactions contemplated thereby are approved by BlackSky’s stockholders and Osprey’s stockholders, and the other conditions to the merger set forth in the merger agreement are satisfied or waived, Merger Sub will merge with and into BlackSky, with BlackSky being the surviving company and a wholly-owned subsidiary of Osprey (the “merger” and the effective time of the merger, the “effective time”). As used in this proxy statement/consent solicitation statement/prospectus, “New BlackSky” refers to Osprey and its consolidated subsidiaries after giving effect to the merger, and “New BlackSky Parent” refers to Osprey after giving effect to the merger.

Pursuant to the merger agreement, at the effective time, each outstanding share of BlackSky capital stock (other than shares of BlackSky Class B common stock, treasury shares and shares with respect to which appraisal rights under the General Corporation Law of the State of Delaware (the “DGCL”) are properly exercised and not withdrawn) will be converted into a number of shares of Osprey Class A common stock based on the Per Share Exchange Ratio applicable thereto (as defined in the merger agreement and described herein) and each outstanding BlackSky restricted stock unit, option and warrant will be converted into an Osprey restricted stock unit, option or warrant based on the Per Share Exchange ratio applicable to shares of BlackSky Class A common stock.

The total number of shares of Osprey Class A common stock issuable to the BlackSky equityholders (including shares issuable upon the exercise or conversion of BlackSky Stock Options, BlackSky Warrants and BlackSky RSU Awards assumed by Osprey) in connection with the merger (which is referred to herein as the “Total Consideration Share Amount”) will be calculated by dividing (x) an amount equal to (a) $925,000,000, plus (b) the aggregate exercise prices that would be paid to BlackSky if all options and warrants to purchase BlackSky capital stock outstanding immediately prior to the effective time were exercised in full, minus (c) an amount (not to exceed $1.8 million) equal to the unfunded portion of a bridge loan BlackSky has the right to incur prior to the closing of the merger, and minus (d) the total consideration payable for shares of BlackSky’s Class B common stock in connection with the merger (which amount will equal less than $1,000 in the aggregate) by (y) $10.00. Based on the aggregate exercise prices of the BlackSky options and warrants anticipated to be outstanding as of immediately prior to the effective time and the amount of the BlackSky bridge loan that is anticipated to remain unfunded as of the effective time, it is currently expected that the total number of shares of Osprey Class A common stock constituting the Total Consideration Share Amount will equal approximately 92,470,589 shares. For an illustrative example calculation of the Total Consideration Share Amount, see the section in this proxy statement/consent solicitation statement/prospectus titled “The Merger Agreement—Merger Consideration”. The actual Total Consideration Share Amount will not be determined until the closing of the merger, and any change in the amounts used to calculate the Total Consideration Share Amount at the time of closing, as compared to the amounts used for purposes of the above estimate, will result in a change to the actual amount of the Total Consideration Share Amount.

Pursuant to the merger agreement, each issued and outstanding share of BlackSky Class B common stock will be converted into the right to receive cash consideration equal to $0.00001 per share. The total cash consideration